HT&E half-yearly report is good news for ARN

HT&E’s half-yearly report is out, showing group radio revenue is up by 7% to $151.4M and EBITA is up by 11%.

The acquisition of 46 regional radio stations from Grant Broadcasters into ARN Regional – completed in January this year – is performing above expectations and delivering margin expansion.

The integration programme is ahead of schedule and continues to gather momentum, with ARN Regional radio revenues up 11%, delivering material cut through to EBITDA which is up 21%.

Speaking to Radio Today just after the results presentation, CEO Ciaran Davis said:

“When we bought the Grant Broadcasters regional business we were very determined to make sure that the strong performances prior to being acquired was maintained after we took ownership. I’m delighted that that has happened and it has been improved even further thanks to our ownership. We’ve expanded margins and revenues, local revenues are going really well. We’ve had some great recent results in some of the key markets.

“The integration in terms of milestones and processes of people and systems is ahead of schedule. All in all, it’s been a very, very healthy six months for the business, both from a logistical organization perspective, but also bottom line.”

ARN metro radio revenues of $97.2 million rose 5% on the previous period and EBITDA grew 4% to $31.4 million.

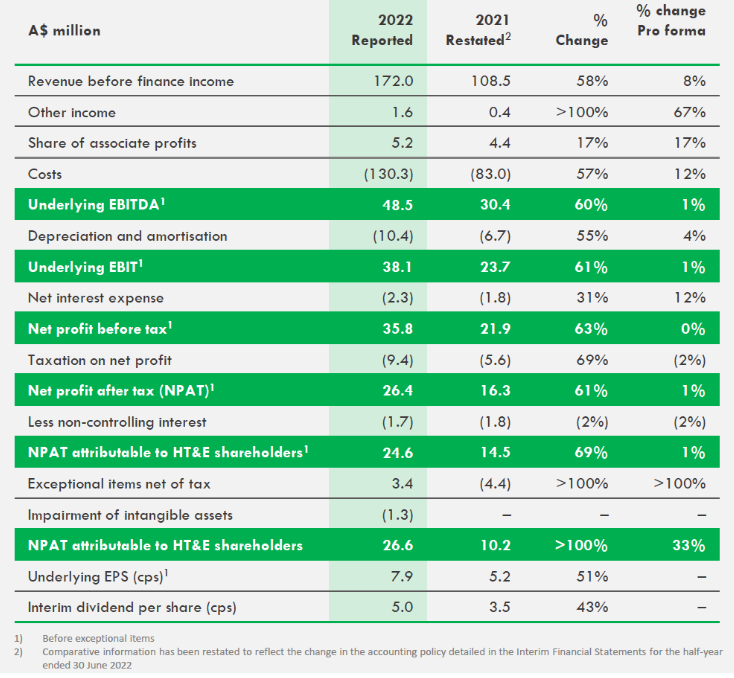

The company saw an overall improvement on revenue of 58% to $172M for the same period in 2021.

Total group costs were up 57% to $130.3 million from $83.0 million with $35.8 million of that ARN Regional related.

The strength of HT&E in the local audio market continued, with ARN holding the #1 FM metropolitan radio network position in Australia for twenty-one consecutive surveys.

Ciaran Davis told Radio Today: “Our ability to merge both our radio commercial activities and our digital commerce activities means that we will invest more in our own content and that billings will increase… it will be much more profitable for us. That’s probably the highlight for us in the last six months, that we’ve been able to grow our content and make it more profitable… profitability of this segment will increase further over the next 12 to 18 months.”

Ratings leadership was also achieved in the key regional markets of Gold Coast, Mackay, Cairns, Bundaberg, Ipswich, Darwin, Launceston, Gympie and Ballarat.

HT&E group revenues from ordinary activities of $172.0 million increased 58%, and underlying NPAT1 of $24.6 million rose 69% on the prior period, owing to the acquisition of ARN Regional.

Davis says podcasting and other digital audio platforms are being integrated into the wider business in a strategic way. “We are focusing on how we can integrate our broadcast and podcast strategies a lot tighter so that we’re getting the benefit of audiences across both platforms. Increasingly we’re starting to see much more brand building commercial opportunities coming through [the podcast platform] that maybe traditional radio doesn’t get a fair share of.”

The company’s new youth offering, CADA, is doing well in audience growth after three months of operation. “It is truly a multi-platform entertainment youth brand. Whether we’re in broadcast audio, digital audio, podcasting, socials, Instagram, Snapchat, TikTok of other digital environments, it’s really all about the content.”

“We’ve grown the audience from 360,000 listeners [when it was The Edge] to a connection with over 3 million people weekly. It is a terrific growth number and I think testament to the fact that we are true to the philosophy we have, the brand fundamentals that we have of creating diverse content that is engaged with culture, that is speaking a language of 18 to 29 year olds in Australia, and is being distributed whenever and wherever they are consuming content.

“I’ve been really pleased with the audience growth. I think advertisers were always going to wait to see what the audience growth is like, we anticipated that. But the level of lean-in and engagement we’re getting from clients, especially new clients, is more than we’ve had traditionally… It’s early days for a revenue perspective, but we have a three year growth plan and we’re probably ahead of schedule.”

Fairly safe to say the welcome obliteration of SCA is complete.

From elderly, bullying dinosaur consultants and management who couldn’t excel in a used car yard, to the current crop of ‘enthusiasts’ trying and failing to output pitiful excuses for content.