Gen Z Males Driving Music

Australian Gen Z males are the biggest music industry revenue drivers. Here’s some insight into what drives the generation and how streaming and radio plays their part.

According to figures released by the world’s largest self-service ticketing platform Eventbrite, nearly a third of Gen Z males (aged between 16-24) purchase music after discovering an artist. They’re also more likely to attend live shows, with an impressive 46% of Gen Z males heading to bars and clubs at least once a month to see live music – this is compared to just 18% of females.

In fact, Gen Z females are twice as likely not to go to a gig because they don’t have someone to go with, and also almost twice as likely to not attend a gig because they don’t know what to go to.

These and other insights into Australian consumers’ entertainment habits are found in the Eventbrite-commissioned Australian Music Consumer Report, presented at a mini-keynote at BigSound.

Eventbrite’s survey of over 2,000 adults from 18-25th July 2016 was undertaken to identify and understand different trends around preferences and behaviour for Australians across three key areas: consuming music, music discovery, and live music.

San Francisco-headquartered Eventbrite, which launched in Australia in 2014, highlighted multiple trends across its report. Eventbrite Australia and New Zealand’s General Manager Phil Silverstone and Chris Carey, CEO of UK-based research agency Media Insight Consulting (MIC), presented the findings.

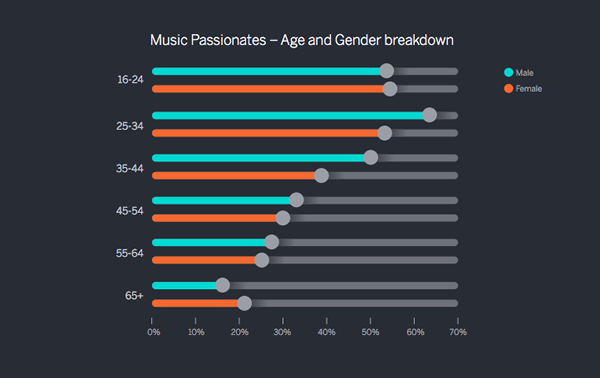

According to the report, Australia has a ‘passion without paying’ issue. 40% of Australians surveyed said music was their life and their #1 passion – that’s almost half the population. However, half of Australians said that while they like music, they don’t spend any money on it.

In terms of age demographics, 16-24-year-old females are the worst offenders for not spending on music despite saying it’s their #1 passion. 25-34-year-old men follow closely behind.

Eventbrite AU/NZ Marketing Manager Brad McIntyre helped to analyse the report’s trends. Speaking to TMN, McIntyre said: “That’s obviously a big opportunity for the industry; in that there’s a large percentage of people who are really passionate about music and love it, but there’s also a big chunk of people who are currently not spending any money on music.”

Speaking to TMN at BigSound, Phil Silverstone said encouraging more music fans to attend live music forms part of Eventbrite’s strategy in Australia and New Zealand.

“Eventbrite has a broad range of diverse events on the platform, which means that there’s something for everyone, regardless of age and gender. We aim to help Australians get out more and experience live events; we’re not focused on one particular group. For example, consumers can visit Eventbrite and see events that are relevant to them specifically on the Eventbrite homepage andevent directory – powered by our smart event recommendation engine.”

One of the key trends Eventbrite identified is that many consumers have grown up on a diet of free, yet illegal, downloads and YouTube streams. Perhaps the aftertaste of P2P sharing sites like Napster and BitTorrent has shaped how Millennials see music, or perhaps free-access YouTube has played a role. What is clear is that the perceived value of music is largely lagging behind other media.

Speaking to TMN at BigSound, MIC CEO Chris Carey said identifying the issue presents an untapped opportunity for music promoters.

“The live business has good data on ticket sales, they know who is coming through the door,” Carey told TMN. “What this data highlights is that there are a number of people, especially females under 35 who have a passion for music but are not spending money on it. Transforming that passion into attendance is the biggest opportunity.”

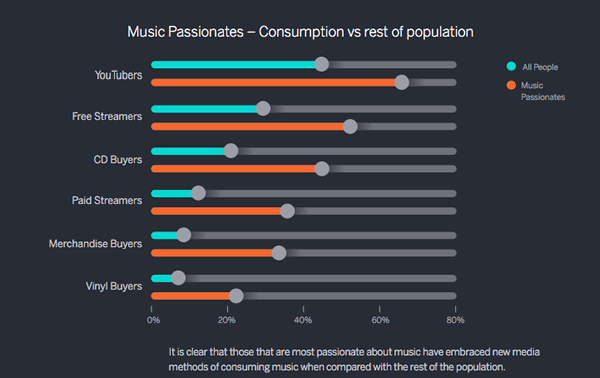

Adding to Australia’s reluctance to convert their passion into financial transactions, is the finding that YouTube is the platform of choice for music discovery. Eventbrite’s research found that 35% of Australians head to YouTube to listen to an artist after discovering them. This shows artists’ new fans aren’t revenue drivers, presenting a challenge for the industry to ensure YouTube is not the full and final destination for core fans.

“Collecting data on a new fan and forming a relationship over time must be a priority,” reads the report. “Requesting mailing list signup across as many touch-points as possible is critical to ensuring this continued engagement with a fan.”

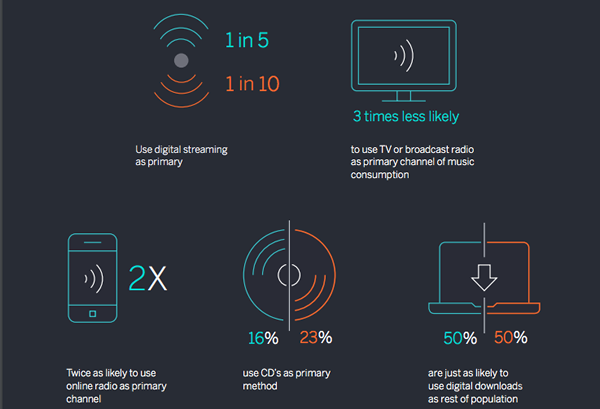

Despite revenue from subscription services growing at 101% in Australia in 2015 and making up 14% of overall sales (ARIA), Eventbrite noted radio and CDs are still the two most common ways Australians consume recorded music. The report said this is because almost half (49%) of Australians are over the age of 44.

However, as Australia’s Millennials move into their 30’s and 40’s, ‘new media’ (YouTube, Digital Streaming, Digital Downloads, Online Radio) will replace traditional radio and CDs. The shift is well on its way; the report notes 75% of Millennials and 86% on Gen Z use new media as the primary channel for consumption of recorded music.

“As new media dominates, the old metrics of success are definitely becoming less relevant,” McIntyre told TMN. “We’re seeing music charts now take into account streaming metrics but there’s a problem inherent of that in that we’re measuring listening as well as consumption.

“We’re capturing how many people are buying a CD for example but we’re not capturing how many times you listen,” he added. “Whereas now with streaming we can actually capture how many times people listen.”

Another finding that stands out is the importance of ‘Word of Mouth’ and personal recommendations. 30% of people surveyed said they discover live music events via a social media post from a friend, versus 22% for social media advertisements and 17% for outdoor ads.

MIC CEO Chris Carey told TMN the report’s ‘Word of Mouth’ statistics provide an opportunity for artist marketers to engage with super fans, aka the zealots who provide 80% of an artist’s revenue.

“Whilst there are more channels than ever to reach an audience, it’s the credible, personal recommendation that carries most weight,” said Carey. “Increasingly YouTubers and celebrities are endorsing products, but the thing that is key is authenticity.

“In the focus on reach, it’s important that marketers don’t overlook the super fans but instead engage with this audience who promote an artist out of pure passion.”

Based on Eventbrite’s research, the platform has identified an opportunity for the music industry to reconnect passion with payment, to leverage peer influencers and enable offline and online identities for all consumers.

“Australian are hugely passionate about music,” said Silverstone. “This is really about how we monetise that through various channels.”

“The debate is now not so much how can recorded music grow again; it’s how big will it be?” added Carey.

The Australian Music Consumer Report can be read in full here.