SCA’s full year’s financial results

Southern Cross Media Group Limited (SCA) has released its financial results for the year ending June 30th 2022, showing increases in underlying profit and higher net debt.

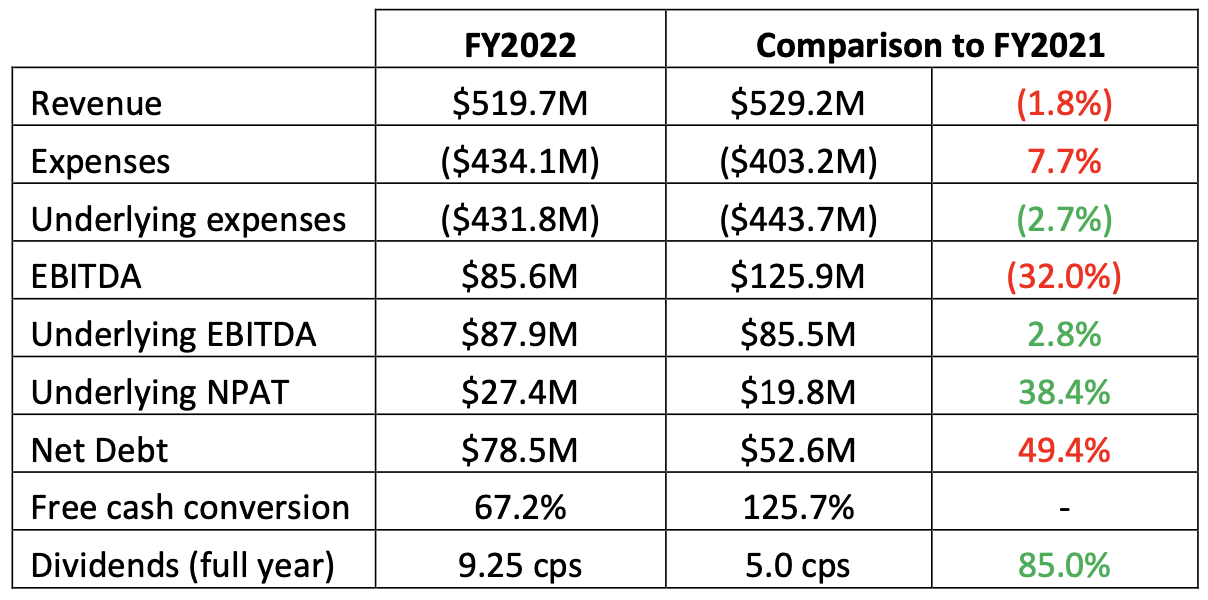

The company reported an underlying net profit after tax of $27.4m which has risen 38.4%, and a net debt of $78.5m which has spiked 49.4%.

Revenue for the financial year was $519.7m, increasing 1.1%, while expenses rose 7.7% to $434.1m.

Underlying expenses were $431.8 and EBITDA, Earnings Before Interest, Taxes, Depreciation and Amortization fell from $125.9m the prior financial year to $85.6m.

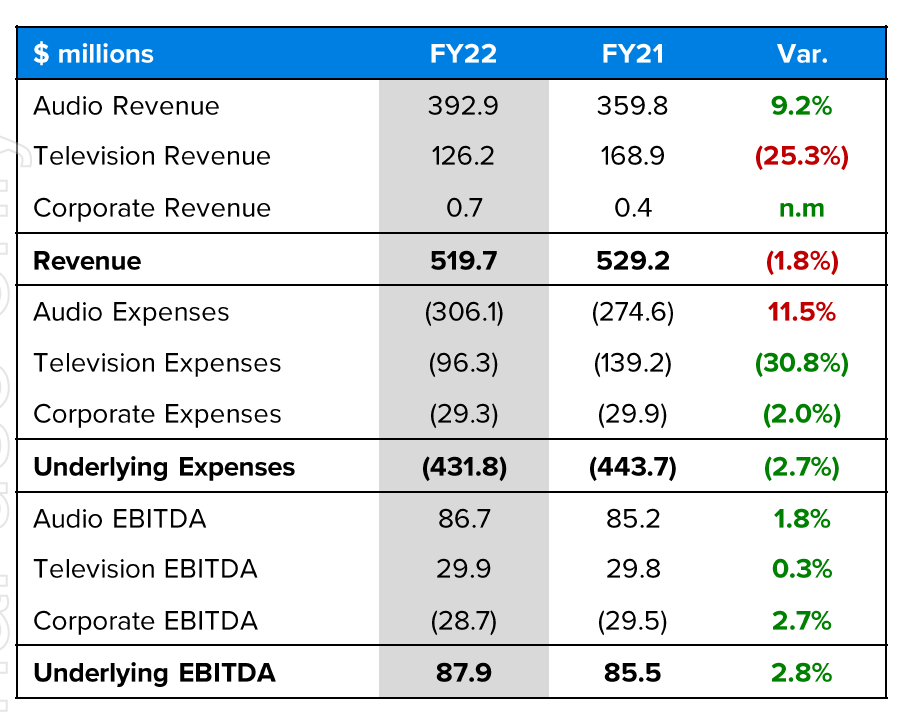

The underlying expenses and underlying EBITDA exclude government grants in FY21 and FY22, impairment charges of $179.4m(net of tax) and $4m of other significant items in FY22.

Speaking to Radio Today after the results announcement CEO Grant Blackley explained:

“80% of our revenue comes from our audio products which are owned and operated, and about 20% of our revenue comes from our television business, of which we take a portion of that revenue on the way through.

“So you have a different contribution coming through at the revenue line. When we were with the affiliation of Channel Nine, we had much higher revenue and ratings than we do now with TEN. Nevertheless, what we have been able to deliver is a flat line in terms of the EBITDA. So some $200 million less revenue, but what we’ve seen is that we’ve been able to mitigate that with lower fees to our affiliate. So that’s that’s one of the changes.

“The second change is that over the course of the last year we are cycling over around about $40 million of Job Keeper, which is no longer afforded to the industry and more broadly to Australians. To that end there was some trailings seen, but essentially we’ve cycled over that in terms of income coming through.

“Our debt levels at the half year were $58 million. We’re now sitting at a debt level a little higher at $78 million. That’s purely because we have a buyback of our own stock. We think our stock is undervalued and we are using debt funded finance to buyback our own shares on the way through… The objective is that that is to add more value for shareholders.

“Buying back your own shares and then deleting those shares means that there is less shares available and in circulation in the marketplace, which means those who are holding the shares end up owning more of the company. On top of that. We’ve also resumed dividends… we are now paying a full year of 9.25 cents per share, fully franked, which is a very strong yield… an improvement in the payout to our shareholders.”

SCA has been investing significantly in LiSTNR which is an expense, but the development is bearing fruit.

LiSTNR crossed over 850,000 signed-in users with the most recent six months growing 3.7 times to 2.7m average monthly streams from 0.7m in the year prior.

Blackley said, “SCA is pleased to report underlying EBITDA of $87.9m and underlying NPAT of $27.4m, up 2.8% and 38.4% receptively on the prior year. With a robust balance sheet and strong cashflow.”

SCA will pay a dividend of 4.75 cents per share this half, representing 85% of NPAT excluding significant items. The dividend will be paid on 4 October 2022.

“Commercial radio audiences in metro markets reached record levels in recent surveys. The total audience of 12 million recorded in GfK Survey 4 was the highest ever and a 7.6% jump over the prior year. SCA’s Hit and Triple M stations have led this rise as audiences return to entertainment and music formats.

“SCA’s broadcast radio revenue grew by 8.0% to $372.1M. This was led by growth in national revenue of 9.7% in metro markets and 8.9% in regional markets. Local advertisers were directly affected by floods and supply chain issues resulting in lower levels of growth in local advertising.”

So they’ve lost a director and their CFO.. Can’t imagine investors would be pleased.

A 12 month investment would see holders with ~45% loss, against the overall share market which is down ~5%.

It needs to be said that Revenue under the current management is poor… Look at 2014 Annual report – Revenue was $640 million and net profit was $296 million. EBITDA was $$179 million..With all the innovation and regional cuts and chops and changes that were supposed to “streamline” processes.. It seems SCA have lost a generation of sales professionals and many talented people have exited..

https://www.southerncrossaustereo.com.au/media/1074/sca_annual-report-2014.pdf

If we break this down, revenue is down slightly and net profit is almost exactly equal to the increase in net debt. It doesn’t matter if audio generates more revenue unless the television assets are going to be unloaded; it’s still the bottom line.

Buying back stock is the worst possible use of debt, the most unproductive way of window-dressing P/E ratios. Everyone knows it’s to make earnings look better than they really are to reach price/performance targets.

The last time any company should buy back stock is when a recession is all but guaranteed. That’s especially the case now the massive 20+ year long bond bubble is starting to deflate, central banks are trying to unwind their insane balance sheets (good luck with that one) therefore rates must rise because they are now in competition with their own treasuries and everyone else who sees yields spiking and wants out before bonds crash completely.

That new corporate debt, while not a large burden on SCA’s balance sheet, still needs to be rolled over at maturity or paid out, either of which will have a knock-on effect for forward earnings.

Gary is right. SCA are a shadow of what they once were. Their lack of investment in their people is their biggest downfall. They will only drop further in coming years.