Radio revenue declines just 1.8% in January

New figures show radio revenue from media agencies declined by 1.8% in January 2021 when compared with January last year.

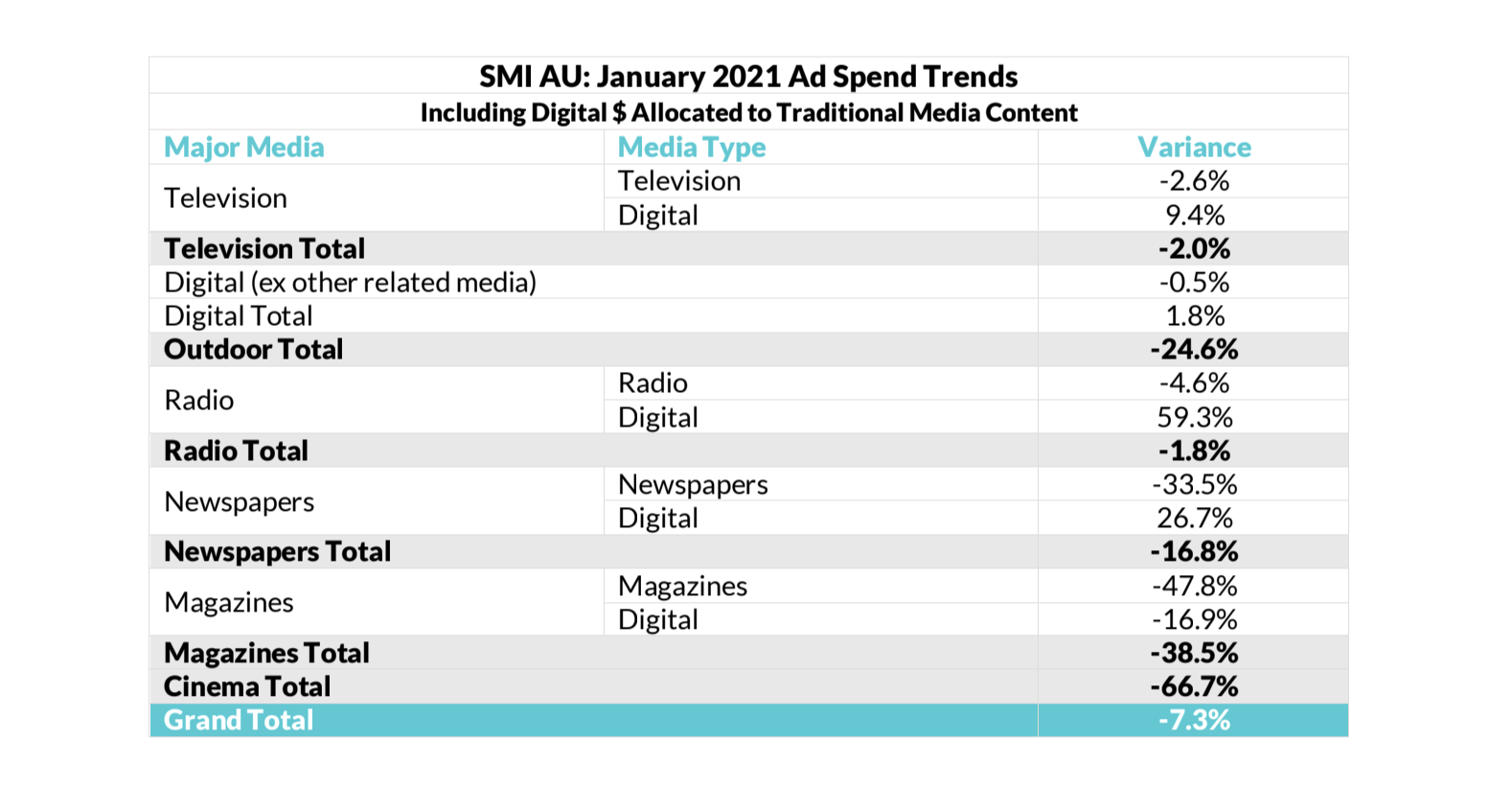

This decline placed radio in good stead compared to other mediums, with television falling 2.0% for the month. Part of this was attributed to the delay in the Australian Open tournament which went to air in February instead of the traditional January. Newspaper revenues from media agencies was down 16.8%, while outdoor suffered by 24.6%. Magazines (down 38.5%) and cinema (down 66.7%) were the hardest hit.

The overall media-agency-funded ad market was down by 7.3% for the month.

Spend for radio’s digital assets was actually up 59.3%, and traditional radio was down 4.6%. Given the size and scale of traditional radio compared to digital spend, however, this still resulted in the overall 1.8% decline for the radio category.

The Standard Media Index (SMI) figures didn’t break out the regions, however SMI AU/NZ managing director, Jane Ractliffe, said regional radio had grown for the third consecutive month.

Ractliffe also said forward-looking data indicates a more consistent recovery is underway.

The figures showed the biggest spenders for the financial year thus far are health care (up 170%), and food/produce/dairy (up 21%). Government bookings for July to January were also up 54% across all mediums.

You can read about last year’s results here.

Are you peeps serious?

Good to see spend in digital radio properties grow albeit off a very low base, but traditional radio revenue is down ‘only’ 4.6% (y-y) when government bookings are up massively; +54% across all media? That’s effectively a government-based bailout of the sector.

With JobKeeper ending in a few weeks, the RBA this week doubling down on their asset buying program yet the US Fed starting to lose control of the bond market, things look pretty bleak for businesses to return to spend. The only exception will be the real estate sector for a short time, until unemployment starts to rise and asset prices collapse with the rapid increase in Treasury yields and flight to safety.