Nine flags ‘disappointment’ as radio revenue falls 24%

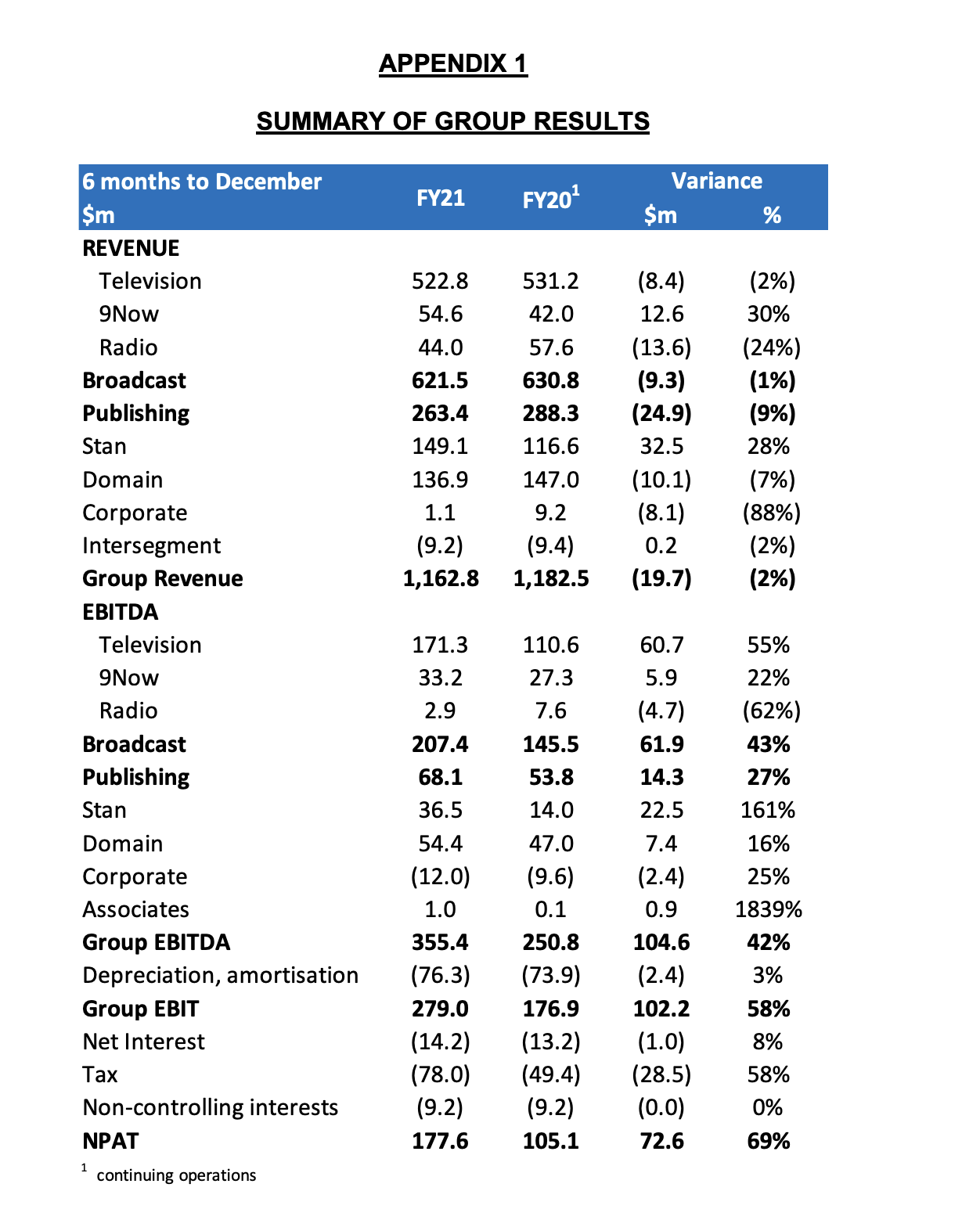

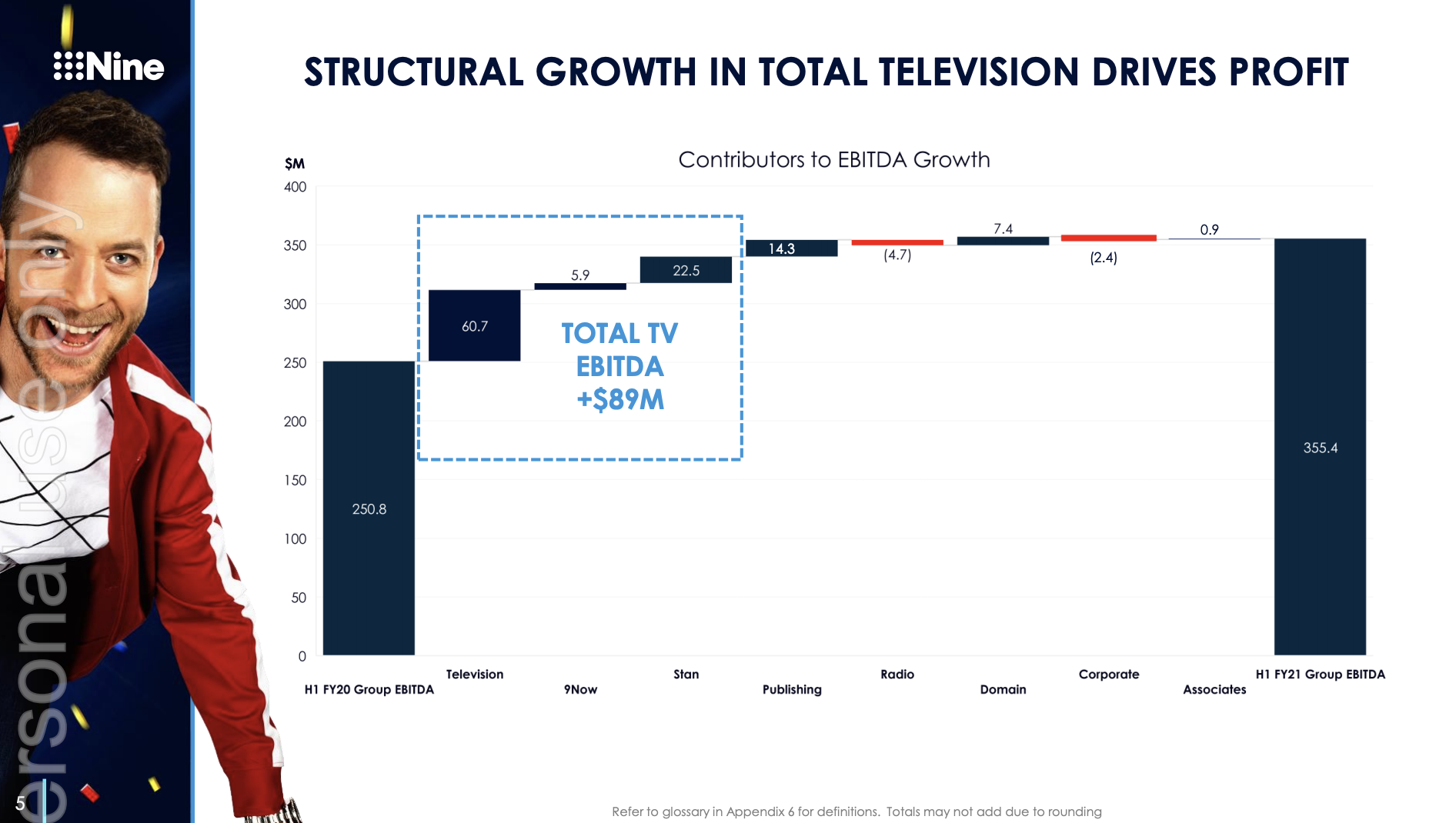

Nine has announced its financial results for the six months to December 31, 2020, with the entire media conglomerate posting profits of $182 million, up 79% from the prior corresponding period, on revenue of $1.2 billion (down 2%). The group EBITDA (earnings before interest, tax, depreciation and amortisation was $355 million, up 42%.

Its radio operation stood out from its other broadcast and digital operations, however, with revenue for the six-month period down 24% to $44.0 million from $57.6 million for the same period in 2019. EBITDA was down 62% from $7.6 million to $2.9 million.

Nine’s chief financial officer, Maria Phillips, said the results for its radio division were disappointing.

“The results from Nine Radio were disappointing, however they disguise some promising trends,” she told investors in a presentation this morning. “Nine has done a great job of refreshing talent with our core talk network growing cumulative audience in thousands in every market, and by a total of 15%.

“As a result, Nine has refocused its radio sales team without adverse effects on the cost base. And we remain confident that our radio results will improve as the ad market continues to recover.”

The group said it anticipates Nine Radio’s performance to improve into the 2022 financial year (kicking off on July 1, 2021), as the radio market recovers. It said radio’s recovery has lagged compared to that of television.

“The radio market generally has a difficult six months, with the advertising recovery lagging that of television,” Nine said in a release to the ASX. “The metro radio ad market declined by 19% across the six months – Nine’s gross ad revenues declining by a similar quantum, with growth in agency share being offset by a softer performance in direct. First-half costs declined by 18% or $9 million, reflecting ongoing cost out and restructuring initiatives.”

The company echoed CFO Phillips’ statement too, noting: “Since Nine’s major format changes through the first half of calendar 2020, audiences have grown across all talk stations. Recent changes in sales structure, coupled with this audience growth, are expected to underpin leverage as the ad market improves.”

Radio forms part of Nine’s Broadcast decision, which also includes free-to-air television and broadcast video on demand (BVOD) service 9Now. The wider segment’s revenue was $621.5 million, down 1% from $630.8 million for the corresponding period in 2019. EBITDA for the division was up 42% to $207.4 million, and costs were down 15% from $485.3 million to $414.1 million.

The company confirmed it has received $8.4 million from the Federal Government from the JobKeeper wage subsidy between July and December, $6.5 million of which went to real estate listings and content portal, Domain. It will repay $2.0 million of JobKeeper payments which it used for Nine Events and its youth publishing outfit Pedestrian.

In the earlier stages of JobKeeper, in the 2020 financial year (between March and June), Nine received $6.6 million in payments.

The company also benefited from government grants of $13.68 million in the six months to December 31, 2020, compared to netting nothing in the six months to December 31, 2019.

Nine’s overall expenses for the business were $893.968 million for the half, down from over $1 billion for the prior corresponding period. Payments to suppliers and employees for the half-year were $943.567 million, down from $1.306 billion, while salary and employee benefit expenses were $341.754 million, down slightly from $343.347 million.

Wholly-owned net debt was down from $278.2 million at the end of 2019 to $149.5 million, while consolidated net debt was $261.0 million, a significant drop from 2019’s $426.1 million.

Outgoing CEO Hugh Marks said the company has performed incredibly well throughout a period of heightened volatility, and had emerged in a very strong position.

“We acted swiftly when circumstances changed, whilst continuing to embrace opportunity and remain true to our vision of building Australia’s leading cross-platform media business,” he said.

He added: “From an advertising perspective, this latest half was a tale of two quarters. The advertising market clearly returned in late September, early and more sharply than we anticipated. And this was led by television, both free-to-air and BVOD… Nine’s consistently strong audience performance, across all our platforms, means we are well positioned to benefit from this improvement in the ad cycle.”

He said the company had learned clear lessons throughout COVID-19, and its focus on strict cost efficiency at its traditional media assets had delivered the profitability it was targeting.

News has not yet emerged of Marks’ replacement, however he used the opportunity to thank staff and farewell investors.

“I’ve had a great five years at Nine, and am confident that I am handing over the reins at the perfect time – of a business which is clearly firing on all cylinders, but that has plenty of scope to accelerate its profitability in the coming few years.”

A bigger problem for Nine Radio is that 2GB is going to lose audience this year.

Ben Fordham has a done a good job maintaining Alan Jones’s audience so far. However, this was throughout a major news period. The ratings for 3AW breakfast shot to 28%!

Ben’s ratings are likely to decline during quieter news cycles.

Also you can expect to see big drops in 2GB afternoons and drive.

A lot of older listeners are telling me that listening to Deb Knight feels like a form of punishment.

I dont want to be the first to say i told you so, but when you cut talent, gag freedom of speech, ban hot topics in the name of PC, employ 2 people only at 2UE, and punish listeners with boredom, then guess what?

Yep, you will lose listeners and advertisers.

Oh bugger it, I told you so.

The decline in radio revenue wouldn’t have anything to do with Nine sacking over 50% of the previous radio sales team would it? And then replacing those sales people with people who have never sold radio…….nah of course not, Nine are geniuses!

I dont think NINE really understand how powerful Direct Sales teams are in Radio and the relationships that go with that. Television can be very transactional. You can just throw a new sales team at clients and expect things to remain the same. Also you cant just throw NINE TV talent on the radio and expect people to listen…

I have to agree with the above comments. A lot of the time 2GB is mind numbing now.

The afternoon and drive slots are the worst offenders. Haven’t tuned in for weeks.

I enjoyed the summer programming. MILES better than what’s on now.

I turn of 2gb of when Deb Knight and Jim Wilson comes on then turn it back on I like listening to Michael Ben Ray and John would love to hear Mark Levi and Luck Grant on more