ARN Media releases 2023 half year results

ARN Media Ltd has today released its results for the six months ending 30 June 2023.

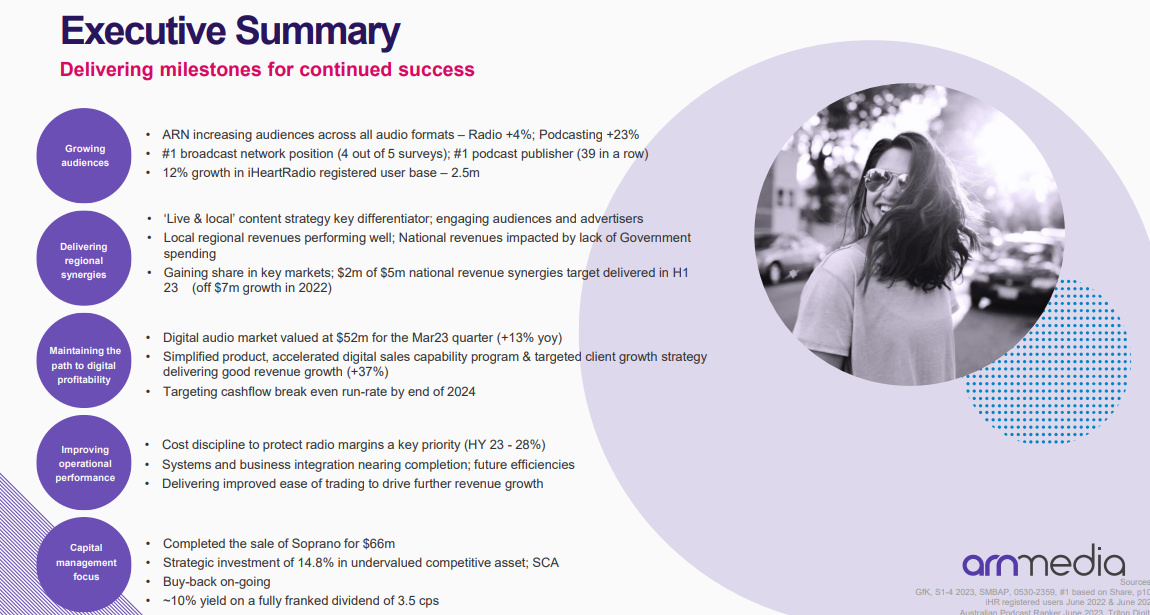

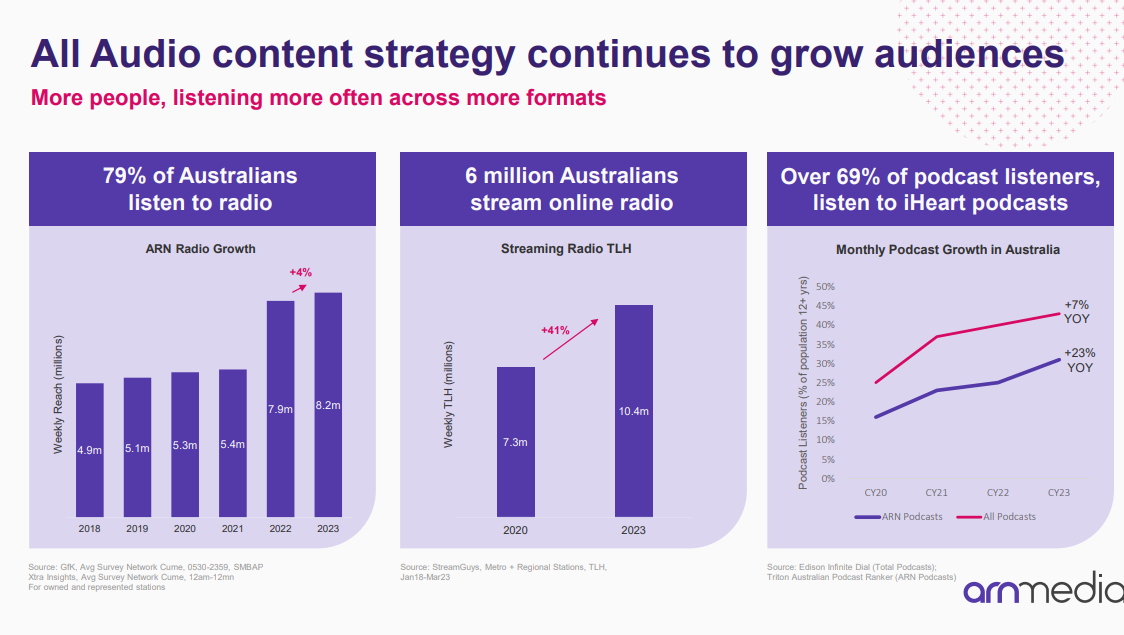

It says in a highly competitive market, ARN’s strong audience ratings performance continued with the business having held the #1 network position for metro AM/FM stations in Australia for four of the last five surveys.

Advertising revenues were impacted by reduced consumer spend and a slowing economy, partly offset by growth in digital audio revenues. Additionally, Government spend was significantly down year on year following the 2022 Federal Election.

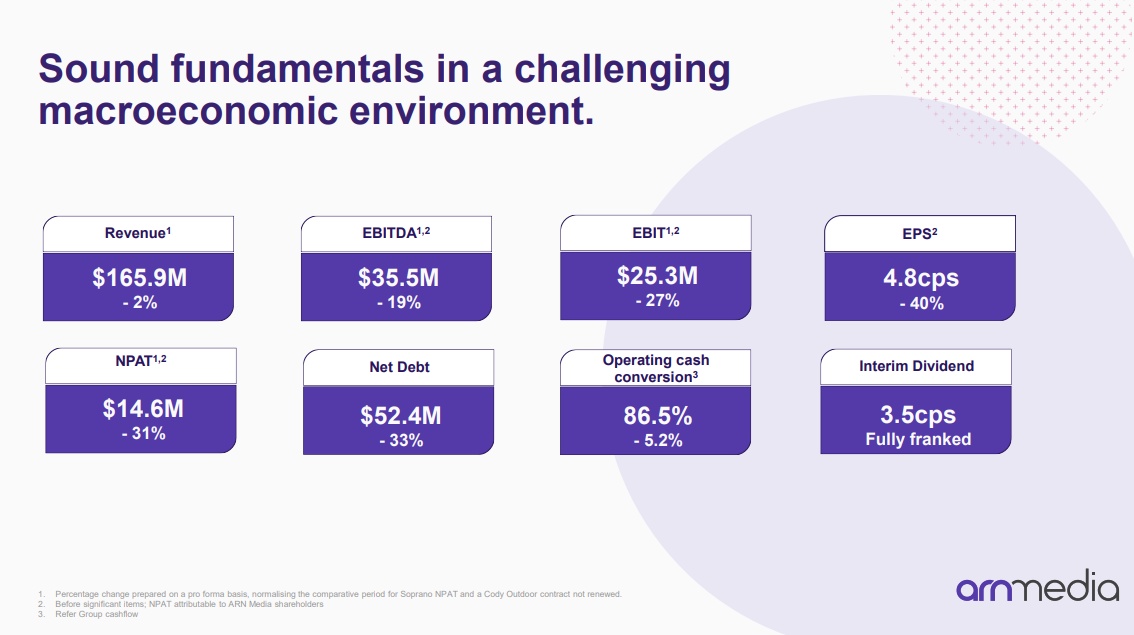

On a statutory basis, ARN Group revenues from ordinary activities of $165.9 million decreased $6.1 million on the prior period and EBITDA of $35.5 million was down 27%.

Net profit after tax attributable to shareholders before significant items (NPAT) was $14.6 million.

Despite continued domestic inflationary pressures, Group operating costs were limited to 2% in the period.

ARN Media Chairman Hamish McLennan says “ARN has delivered a good result in a highly competitive market against a backdrop of reduced consumer spend, a slowing economy and a reduction in government spend, which has impacted revenues.”

“The strength of audio is undeniable as both radio and podcast listening continues to grow. We continue to have the number one metropolitan network in Australia with our newly integrated regional network performing strongly as advertisers increasingly pay attention to audio in regional Australia.”

“Importantly, the final components of the regional integration with our metropolitan network are on-track for completion in 2023.”

“We are strong believers in the future of the sector reflecting our decision in June to acquire a 14.8% interest in Southern Cross Austereo for $38.3 million – a business we know well in a sector that is undervalued, positioning ourselves for future value creation.”

The Southern Cross Austereo investment was funded from the $66.3 million received from the sale of Soprano in March 2023, with additional monies used to pay down debt.

ARN says the balance sheet of the Group remains strong with net debt of $52.4 million and leverage on a preAASB 16 basis of 0.8 times EBITDA, before significant items.

Subject to trading conditions, the Group expects to maintain debt levels of under one times EBITDA before significant items, considered an appropriate level of gearing, which gives ARN Media flexibility to continue to pursue its ‘All Audio’ strategy and capitalise on any future growth opportunities.

The Board remains committed to maintaining strong dividends for shareholders thanks to the high cash generating nature of the business with free cash conversion of 85.5%. The Company declared a half year fully franked dividend of 3.5 cents per share, equating to an effective yield in excess of 10%.

In addition, ARN Media’s accretive share buy-back was maintained during the period delivering improved returns for shareholders.

ARN Media CEO & Managing Director Ciaran Davis says “We are seeing increasingly positive trends in all of our audio measurement metrics.”

“Metro commercial radio audiences continue to grow in listener numbers, in key day part listening and the amount of content consumed, with the latest industry survey showing 82% of the metro population aged 10 years and older listened to radio in the past 7 days, which is an extraordinary indicator of the power of audio.”

“Our regional network continues to deliver over 147 localised shows, more than any other Australian audio broadcaster, and our leadership in podcasting resulted in a significant lift in digital audio advertising spend, making it the fastest growing category of all general display advertising.”

“ARN Media is seeing improved revenue conditions in quarter 3 after gaining market share in July and we are confident our ‘All Audio’ strategy will deliver a strong and integrated audio business for listeners and clients.”

Profit down from $26M last year to $15M this year and their investment in SCA has already lost half its value. Can they even afford Kyle and Jackie O’s next contract?

Wait until they cull staff from regional stations. Janet Cameron put a 2 year staff retention clause into the sale contract.