The Ratings Winners in 2014

Bob Peters is a Director of Global Media Analysis Pty Ltd, a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries.

His company has released detailed analysis on the sector for the 2014 Metropolitan Radio Ratings. Fantastic insights and detail into the state of play for the big industry players.

Summary

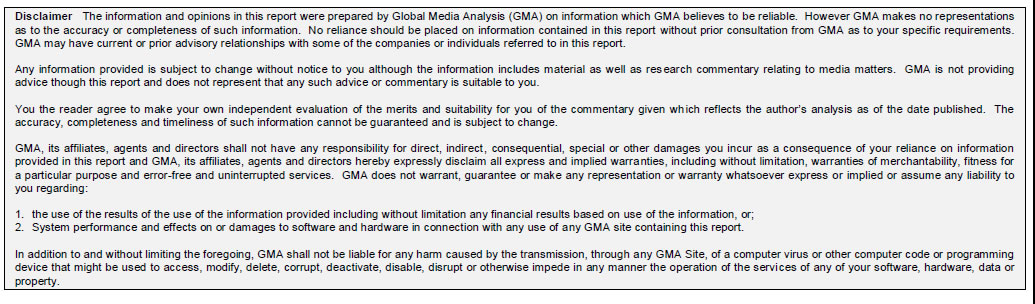

Nova Entertainment and ARN were the big ratings winners over the eight surveys during the fiscal year ending June 2014. They managed to increase their average audience numbers by 6.2% and 4.5% respectively, while all other radio groups, including the ABC, to varying degrees experienced declines in average audience numbers over the same period.

Southern Cross Austereo (SCA), Fairfax (FXJ) and Macquarie Radio Network (MRN) suffered the largest falls, with average 10+ audiences declining by 11.9%, 10.2% and 9.1% respectively during fiscal 2014.

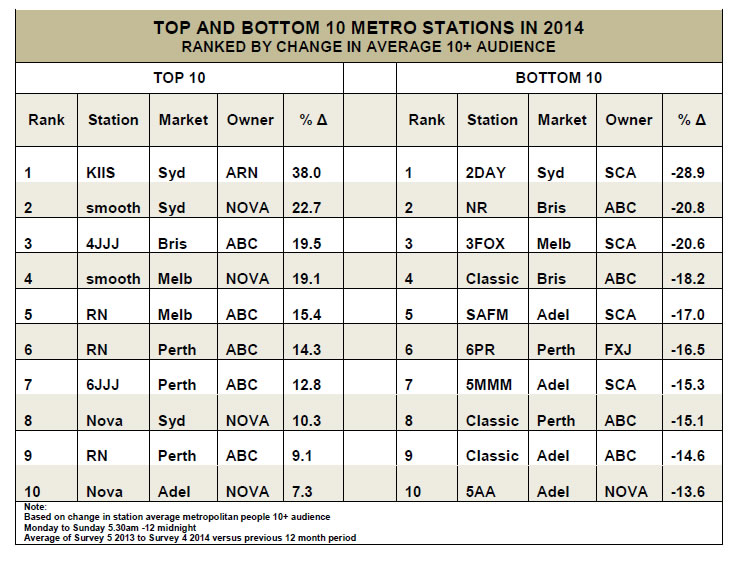

Amongst the higher rating individual metropolitan stations, the biggest increases in average 10+ audiences were generated by ARN’s KIIS in Sydney (+38.0%) and Nova Entertainment’s smooth fm branded stations in Sydney (+22.7%) and Melbourne (+19.1%). On the downside, the biggest losers were three stations from SCA’s Today network, namely 2DAY in Sydney (-28.9%), 3FOX in Melbourne (-20.6%) and SAFM in Adelaide (-17.0%).

Across the full fiscal year, the ABC retained a leading 24.3% share of the total metropolitan average 10+ audiences, followed by SCA with 15.7%, Nova Entertainment with 14.2%, ARN with 14.1% and Fairfax with 11.2%.

Nova Entertainment and ARN’s audience growth was particularly impressive when viewed against metropolitan radio’s relatively benign aggregate performance over the past twelve months which saw potential and cumulative audiences increase by 1.1% and 1.8% respectively, while average 10+ audiences slipped by 1.2%.

All rated stations (both commercial and ABC) as a group recorded a 3.1% fall in average audiences, but that was in part offset by a sizeable 13.9% increase in average audiences to all non-rated stations (AM , FM and digital), with the new digital stations seemingly gaining increased traction with metropolitan radio listeners.

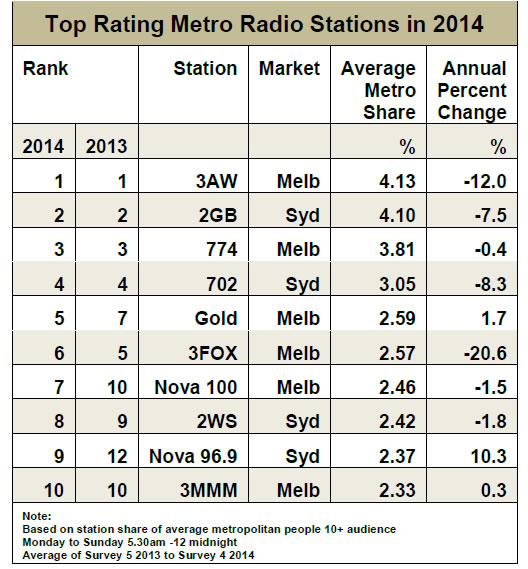

Amongst the rated stations, FM stations in aggregate saw their average 10+ audiences slide by a modest 1.0%, whereas all rated stations on the AM band in total suffered a greater 6.1% reduction.

On the AM band, there also was a curious disparity during the year between the ratings performances of the ABC and commercial AM stations employing news-talk formats. While the ABC’s three news-talk networks (Local Radio, RN & NewsRadio) in aggregate saw their average 10+ audiences slip by a modest 2.0%, the six commercial AM stations employing such formats (2GB,2UE,3AW,4BC,5AA & 6PR) saw their combined audiences fall by a substantial 10.9%.

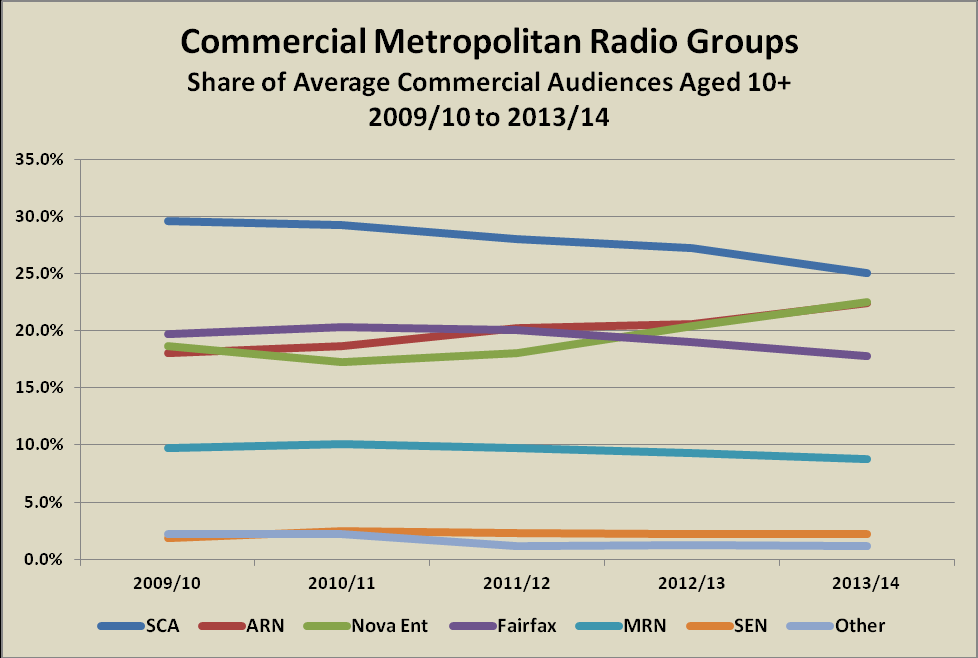

But, while each suffered varying degrees of audience loss during the year, the ranking of the top four metropolitan stations remained unchanged between 2013 and 2014 and each were stations which employed a news-talk format. Fairfax’s 3AW remained on top despite a 12.0% loss in average 10+ listeners, closely followed by MRN’s 2GB, whose audiences declined by a lesser 7.5%. Not far behind were the ABC’s Local Radio services in Melbourne (774 with only 0.4% fewer listeners) and Sydney (702 down by 8.3%).

.jpg)

Nova Entertainment – Moves Up to #2 Position

Fiscal 2014 was a very good year for Nova Entertainment’s FM stations. The five station Nova-branded network became the top rating commercial network for all but the first of the year’s eight surveys, on the back of a 3.2% average audience increase; while the two smooth fm branded stations in Sydney and Melbourne managed to increase their combined 10+ audience by an impressive 20.9%.

Fiscal 2014 was a very good year for Nova Entertainment’s FM stations. The five station Nova-branded network became the top rating commercial network for all but the first of the year’s eight surveys, on the back of a 3.2% average audience increase; while the two smooth fm branded stations in Sydney and Melbourne managed to increase their combined 10+ audience by an impressive 20.9%.

Consequently, despite a disappointing 13.5% drop in average 10+ audiences at AM news talk station 5AA in Adelaide, the Nova Entertainment group in total managed to narrowly displace ARN as commercial radio’s second largest group in terms of average audience numbers, with an increased 14.2% share of total metro 10+ audiences (13.2% in FY 2013) and an increased 22.6% share of all commercial radio listeners (previously 20.4%), during the just-ended financial year.

ARN – A Stunning Second Half

.jpg) For ARN, fiscal 2014 was a year of two quite different halves in terms of ratings performance. During the first half of the year, overall 10+ audiences declined by 0.8%, but that was more than reversed in the second half with a sizeable 9.6% rise in average audiences, which was in large part fuelled by the dramatic ratings improvement at the rebranded KIIS in Sydney during the most recent six month period.

For ARN, fiscal 2014 was a year of two quite different halves in terms of ratings performance. During the first half of the year, overall 10+ audiences declined by 0.8%, but that was more than reversed in the second half with a sizeable 9.6% rise in average audiences, which was in large part fuelled by the dramatic ratings improvement at the rebranded KIIS in Sydney during the most recent six month period.

Across the full fiscal year, ARN’s average 10+ audiences grew by 4.5%, which represented an increased 14.1% total metro audience share (up from 13.3% in FY 2013) and an increased 22.5% commercial audience share (previously 20.6%). This gave ARN an overall average 10+ audience which was 0.4% less than Nova Entertainment’s, thereby placing it third in the overall commercial group rankings. However, during last three surveys of the fiscal year, ARN’s aggregate audiences were bettering those of Nova Entertainment by an increasing margin (e.g. 14.2% higher during survey 4 of 2014).

Of course the highlight of metropolitan radio ratings during fiscal 2014 was the 57.9% jump in average 10+ audiences experienced in the second half of the year by the rebranded KIIS, which over the full year enjoyed a 38.0% audience increase. ARN also benefited from pleasing audience growth at its two AM music stations, with Cruise 1323 in Adelaide and 4KQ in Brisbane increasing their average 10+ listenership during the year by 5.6% and 2.3% respectively.

.png)

Southern Cross Austereo – An Annus Horribilis

.jpg) It is not an exaggeration to describe fiscal 2014 as being a horrible year for SCA in terms of metropolitan ratings performance. The overall 11.9% reduction in group 10+ average audiences was the product of both a shocking 16.4% decline in audiences at the once dominant Today network combined with a lesser but still worrying 5.8% reduction in 10+ listeners to the MMM network.

It is not an exaggeration to describe fiscal 2014 as being a horrible year for SCA in terms of metropolitan ratings performance. The overall 11.9% reduction in group 10+ average audiences was the product of both a shocking 16.4% decline in audiences at the once dominant Today network combined with a lesser but still worrying 5.8% reduction in 10+ listeners to the MMM network.

While an adverse ratings hit at the Today network was anticipated as a result of the mid-year defection of 2DAY’s top-rating, and occasionally controversial, Sydney FM breakfast team to ARN’s KIIS, few industry pundits predicted either the magnitude of Today’s audience declines in Sydney (down 28.9%) or of the compounding declines registered at network sister stations 3FOX in Melbourne (down 20.6%) and SAFM in Adelaide (down 17.0%).

Although SCA remained the largest commercial radio group during fiscal 2014 with a total metropolitan 10+ audience share of 15.7% (down from 17.6% in FY 2013) and a commercial 10+ audience share of 25.0% (previously 27.3%); and although it retains the valuable advantage of being the only commercial radio group with FM duopolies in each of the five metro markets, its continued premier position in the commercial ratings stakes is by no means certain, given that it was out-rated by ARN during the last three ratings surveys of the year.

.png)

Fairfax – Disturbing Declines in News-Talk

Fairfax’s seven metropolitan radio stations in total recorded a 10.2% reduction in average 10+ audiences during FY 2014, with the four news-talk formatted stations suffering more than twice the listener decline of their three music-formatted stable-mates.

Fairfax’s seven metropolitan radio stations in total recorded a 10.2% reduction in average 10+ audiences during FY 2014, with the four news-talk formatted stations suffering more than twice the listener decline of their three music-formatted stable-mates.

The four AM news-talk formatted stations (2UE, 3AW, 4BC & 6PR) saw their combined 10+ listenership sink by 12.3%, with the biggest fall occurring at 6PR in Perth, where average audiences were down by 16.5%, and the smallest decline being experienced by 4BC in Brisbane (-8.5%).

Arguably the group’s top priority should be to address the continuing slide at Sydney’s 2UE where 10+ listener numbers fell by 12.0% last year and were 35.5% less than they had been five years ago.

While flagship news-talk station 3AW in Melbourne also experienced a 12.0% fall in average audience numbers during the year, it nevertheless managed to retain its long-standing position as Australia’s largest metropolitan radio station in terms of average listener numbers.

Amongst the three music stations, 96FM in Perth had the smallest audience decline (-4.2%), followed by Magic 1278 in Melbourne (-6.3%) and the recently rebranded Magic 882 in Brisbane (-8.9%).

Fairfax remained the fourth largest commercial network with an 11.2% share of the total metro 10+ audience and a 17.8% share of total 10+ commercial radio listeners.

MRN – 2GB Closing in on the #1 Ranking

The performance of Macquarie Radio Network’s two metropolitan AM stations in Sydney was also disappointing with a combined 9.1% overall average audience decline during the year. However, in contrast to Fairfax, MRN’s news-talk formatted 2GB suffered a smaller audience decline than did its music formatted sibling 2CH (-13.5%).

The performance of Macquarie Radio Network’s two metropolitan AM stations in Sydney was also disappointing with a combined 9.1% overall average audience decline during the year. However, in contrast to Fairfax, MRN’s news-talk formatted 2GB suffered a smaller audience decline than did its music formatted sibling 2CH (-13.5%).

But, despite a 7.5% fall in average 10+ listenership, 2GB remained Sydney’s top-rated station by a considerable margin and it was only 0.7% short of toppling 3AW as the nation’s largest station in terms of average audience numbers.

Although MRN owns only two metro stations, because each are located in Sydney, they together give the group at 5.5% total share and an 8.8% commercial share of the 10+ audience in the five metro markets.

Pacific Star and Capital Radio – Modest Audience Declines

Pacific Star Network’s sports formatted station SEN in Melbourne saw its average 10+ audience fall by 5.2% during the year, while its AM stable-mate MyMP remained unrated.

SEN’s share of the commercial 10+ metro audience remained virtually unchanged during the year.

Over in Perth, Capital Radio’s music formatted 6IX experienced a modest 2.9% decline in average10+ listener numbers.

ABC – Out-Performed the Commercial Sector

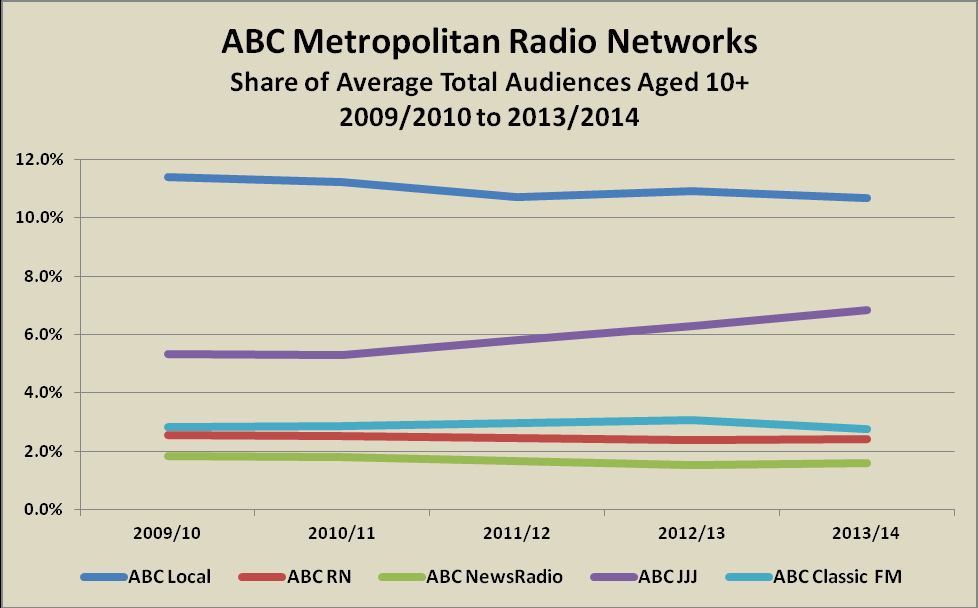

As a group, the five metropolitan radio networks of the Australian Broadcasting Corporation out-performed their commercial counterparts during fiscal 2014, experiencing only a small 0.7% decline in average 10+ audiences, with a 1.4% increase in FM listeners partly offsetting a 2.0% fall in AM listening. Consequently, the ABC’s share of total metropolitan radio listening rose slightly, from 24.2% to 24.3%, during the year.

As a group, the five metropolitan radio networks of the Australian Broadcasting Corporation out-performed their commercial counterparts during fiscal 2014, experiencing only a small 0.7% decline in average 10+ audiences, with a 1.4% increase in FM listeners partly offsetting a 2.0% fall in AM listening. Consequently, the ABC’s share of total metropolitan radio listening rose slightly, from 24.2% to 24.3%, during the year.

Performance amongst the five AM stations of the flagship Local Radio network was mixed. While the network experienced an overall 3.4% fall in average 10+ audiences, stations 891 in Adelaide and 720 in Perth actually increased listeners by 2.9% and 1.0% respectively and listenership at network juggernaut 774 in Melbourne (-0.4%) was virtually steady. In contrast, sizeable audience falls were recorded by 612 in Brisbane (-9.0%) and 702 in Sydney (-8.3%).

During the year, stations 774 in Melbourne and 702 in Sydney each retained their respective positions as the third and fourth largest metropolitan radio stations in terms of average 10+ listener numbers.

The ABC’s two other more specialist metropolitan AM networks each increased their aggregate average 10+ audience numbers in FY 2014, with the NewsRadio (NR) network up by 3.8% and Radio National (RN) 0.6% ahead, although there was considerable variation in audience movements at individual stations within each of the two networks.

For example, average NewsRadio audiences in Melbourne rose by 15.4%, but in Brisbane they fell by 20.8%. Similarly, at Radio National ratings performance ranged from a 9.1% average audience increase at station 6RN in Perth to a 7.1% fall at Adelaide station 5RN.

The JJJ network on the FM band was the ABC’s star performer during the year with a 7.4% increase in aggregate average 10+ audiences and with growth in all markets led by very strong improvements in Brisbane (+19.5%) and Perth (+12.8%). The performance of 6JJJ in Perth was particularly impressive because it not only captured a larger audience than its Local Radio sister station ABC 720, but it also finished the year as the market’s #4 station, and fell just 0.12% short of capturing the #3 spot.

In contrast to the situation at the Triple J network, Classic FM was the ABC’s poorest performer in fiscal 2014, with an overall 11.0% fall in average 10+ listeners and varying audience declines in each market, with particularly large drops recorded in Brisbane (-18.2%), Perth (-15.1%) and Adelaide (-14.6%).

.png) Further Information For further information pertaining to this research report, contact Bob Peters of Global Media Analysis at: [email protected]

Further Information For further information pertaining to this research report, contact Bob Peters of Global Media Analysis at: [email protected]