Nine writes down value of radio assets as revenue takes ‘significant’ hit during pandemic

Nine has released its financial results to market, with its radio assets not performing as strongly as the other media offerings in its stable.

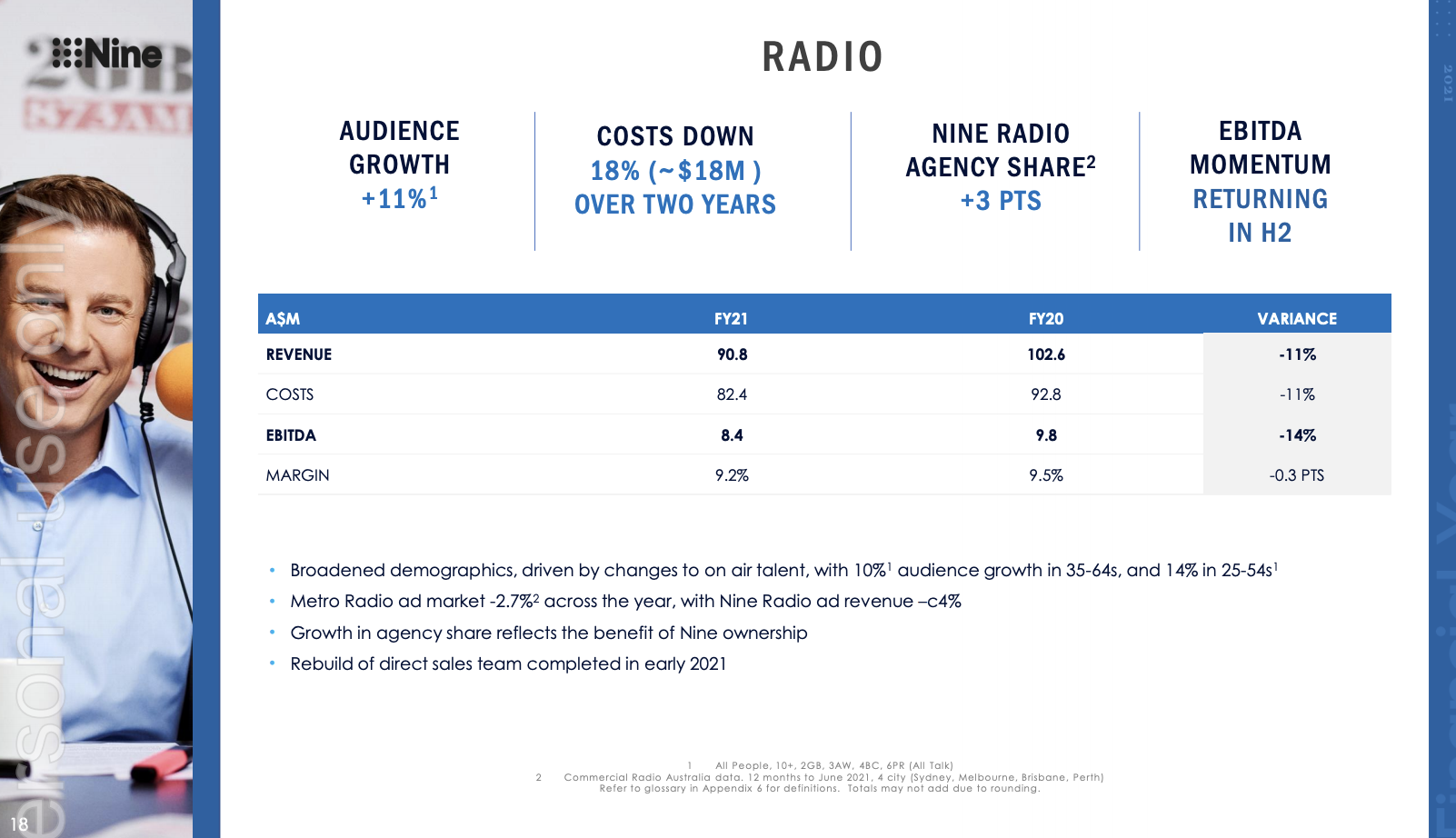

Revenue for Nine Radio was down 11.5% over the course of the 2021 financial year, from $102.6 million in 2020 to $90.8 million. Its 2020 financial report revealed revenue for that year was already down 20% year-on-year from 2019.

Its financial report attributed this year’s decline to the discontinued Map and Page business, as well as a 3% decline in the metro radio market. Nine Radio also noted it had a smaller share of the ad market share this financial year.

Earnings before interest, tax, depreciation and amortisation (EBITDA) for the business unit was $8.4 million, a decline of 14% from last year’s $9.8 million.

Nine said since taking full ownership of the former Macquarie Media radio brands, it has restructured much of the business and continued to achieve cost efficiencies. Approximately $18 million worth of costs have been stripped from the radio business over two years.

The business also took a hit in terms of goodwill.

Nine already owned a majority 54.5% stake in Macquarie Media due to the 2018 merger of Fairfax and Nine. It bought the remaining stake for $113.9 million in 2019, valuing the business at $275.4 million.

Today, however, its financials revealed a $61.5 million impairment charge, which effectively means the asset can no longer demonstrate the financial results that were expected at the time of its purchase.

$44.8 million of this related to the goodwill of Nine Radio, while a further $16.7 million was attributed to the impairment of radio licences. The goodwill of Nine’s radio assets was listed as $44.8 million in the 2020 annual report. Today’s adjustment thus means the business unit is no longer carrying any goodwill.

“An impairment charge of $61.5 million has been recognised in respect of the Nine Radio cash generating unit. The decrease in the estimated recoverable amount of this business compared to the prior year isn a result of the continued impact of the COVID-19 pandemic on this market,” the report revealed.

“The COVID-19 pandemic has significantly impacted the radio advertising market in the year to 30 June 2021, with a slower recovery evident in this market compared to other markets in which the Group operated. Given the uncertain timing and extent of recovery in this market, as well as the ongoing disruption from digital mediums, management has adjusted longer-term growth assumptions of this CGU,” it added.

There was hope on the horizon, however, with Nine noting its revenue for Q1 of the 2022 financial year (July 1 to September 30, 2021) is expected to see double-digit percentage growth with share improvement across both agency and local ad sales.

“Coupled with Nine Radio’s restructured cost base, this is expected to underpin strong profit leverage as the ad market recovers,” a statement said.

New CEO Mike Sneesby also focused on the positive in a note to staff, seen by Radio Today.

“Radio has had a disrupted market deeply impacted by COVID, but almost two years in, we are seeing that business reset its profitability and ensure its long-term sustainability. This year Radio reported revenue of $90.8m and profit of $8.4m but the key figures to look at are the reduction in costs (down 18% in two years) and the growth in demographics which, across the network, has resulted in 10% audience growth in 35-64s and 14% in 25-54s as we renewed the on-air lineups,” he said.

Overall, the company performed better than its radio assets, boasting an 8% increase in revenue to $2.3 billion, and group EBITDA of $464.7 million, up 43%.

Its net profit after tax (NPAT) was $277.5 million, a jump of 76%.

More broadly, the company – which also has assets spanning television, broadcast video on demand (BVOD), publishing and subscription video on demand (SVOD) – said it would be looking at content which works across multiple platforms.

Sneesby said the company was starting the new financial year with strong momentum across all its businesses in terms of audiences and revenue.

“With the foundation of Nine’s unique assets, strong cash flows and a supportive Board, we have a clear vision for the future as Australia’s Media Company,” he said.

Guess you cant run a radio network like you do a television network.

Maybe Nine Radio Network will be available for a bargain basement price very soon.

Then things will get back to normal.

This was to be expected because this is what happens when people make decisions about radio stations when they know nothing about radio

Listeners make a radio station, not new ownership, the fork in the road happened when Adam Lang dumped Chris Smith from noon time, Price was a disaster, in the end, Lang & Price were fired & the conservative listeners switched off & it’s never been the same. Last ratings, breakfast was beaten by FM. Solution to get back to No 1 is, Breaky Michael McClaren, 9 am Hadley, Noon Smith & drive Fordham. Then all your conservative listeners will flock back = more advertising $$$