ARN and Nova Shine as Austereo Fades.

Bob Peters from Global Media Analysis runs the ruler across the Metro FM Networks. His verdict: ARN and Nova Shine as Austereo Fades.

Bob’s full report below.

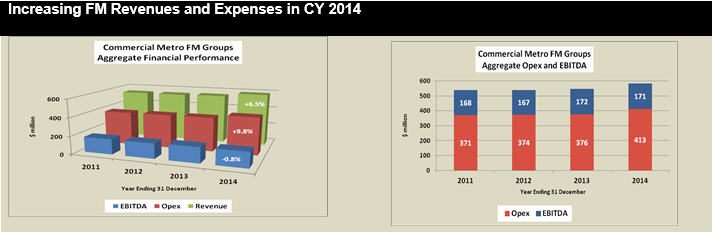

Calendar 2014 was a year of above average growth in aggregate revenues and operating expenses, but slightly reduced profitability, for Australia’s three commercial metropolitan FM radio groups.

The Australian Radio Network (ARN) and Nova Entertainment (Nova) each enjoyed solid increases in both revenues and profits, while CY2014 was yet another year of worrying financial decline for the faltering metro radio operations of Southern Cross Austereo (Austereo).

Revenue Performance

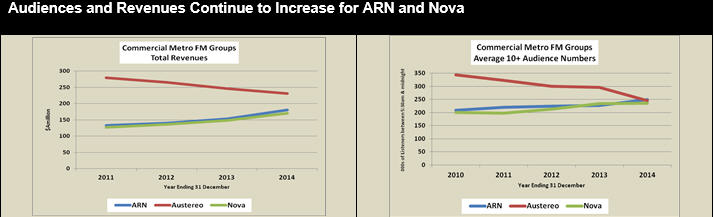

Aggregate total revenues of the three metro FM groups rose by 6.5% in CY2014. That was the result of strong growth by ARN (up 18.2%) and Nova (up 15.2%) more than offsetting a 6.0% revenue fall experienced by Austereo.

Over the past three calendar years, ARN and Nova have increased their total revenues by 35.8% and 35.0% respectively, in large part at the expense of Austereo whose revenues have declined by 17.3% over that same period.

Whereas Austereo’s radio revenues had been more than double those of either ARN or Nova in CY2011, by CY2014 they were only 28% greater than those of the former and 35% higher than those of the latter.

Given that each of the three metro FM groups had virtually identically sized average 10+ listener numbers during CY2014 , it will be interesting to see whether Austereo will be able to maintain its recent and historical disproportionate share of revenues into the future.

[1]Average quarter hour audiences aged 10+, Monday to Sunday, 5:30am to midnight as measured by GFK Media on behalf of Commercial Radio Australia.

Operating Expenses

Aggregate operating expenses for the three metro FM groups increased by 9.8% in CY2014.

ARN’s operating costs rose by a sizeable 21.1%; while Nova’s grew by 14.5%. In contrast, the opex at Austereo was virtually static, increasing by a negligible 0.6%.

Nevertheless, Austereo’s operating cost structure remained significantly higher than those of either of its two major competitors, being 35% greater than Nova’s and 50% more than ARN’s in CY2014.

Operating Profits

Although the combined operating profits of the three commercial metro FM groups were largely unchanged in CY2014, that aggregate result masked a very significant structural shift in the allocation of profits between the three competitors, with ARN, for the first time ever, generating greater earnings before interest, tax, depreciation and amortisation (EBITDA) than Austereo.

While ARN had generated less than half of the EBITDA of Austereo in CY2011, by CY2014 its operating profits were more than 11% greater than those of Austereo.

Similarly, Nova also continued to close the EBITDA gap between itself and Austereo. Having generated little more than one quarter of Austereo’s EBITDA in CY2011, by CY2014 its operating profits had increased to almost three quarters of those recorded by Austereo.

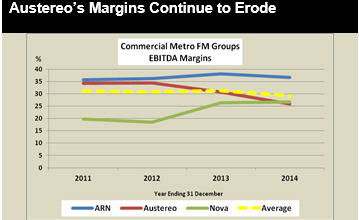

Profit Margins

Average EBITDA margins of the three commercial metro FM operators declined in CY2014, falling from 31.4% down to a still-impressive 29.2%, as combined operating expenses growth of 9.8% out-paced a lesser revenue rise of 6.5%.

Average EBITDA margins of the three commercial metro FM operators declined in CY2014, falling from 31.4% down to a still-impressive 29.2%, as combined operating expenses growth of 9.8% out-paced a lesser revenue rise of 6.5%.

Nova was the only major metro FM operator to improve its profit margin in the year, while Austereo continued to suffer significant margin erosion.