ARN report big profit jump, NZME off slightly

APN News & Media, the owners of ARN and NZME have released their results for 2015; posting a full-year loss. Results in the radio divisions were mixed with The Australian Radio Network seeing strong revenue and profit growth, again the star of the APN stable; and NZME slipping slightly in the softer New Zealand economy.

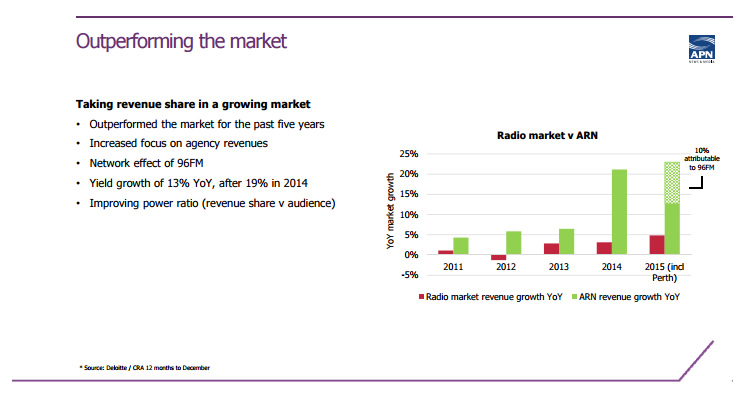

APN have highlighted that ARN has been outperforming the broad radio market for the last five years and has increased their revenue share versus audience.

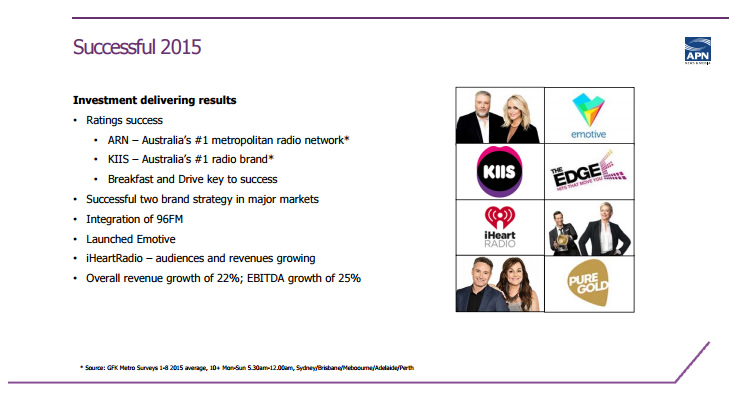

Overall ARN revenue was up 22% in 2015 to $221m, with costs increasing by 21% to $138m. EBITDA for ARN was an impressive $82.8m. The increases in costs and revenue was significantly influenced on a year on year basis by the inclusion of 96FM Perth into the group; however even allowing for earnings from 96FM, the financial results from the rest of the ARN group are very strong.

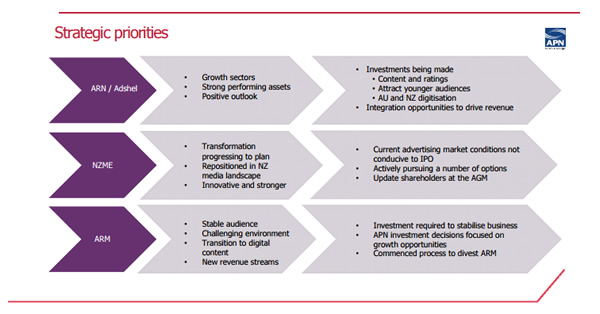

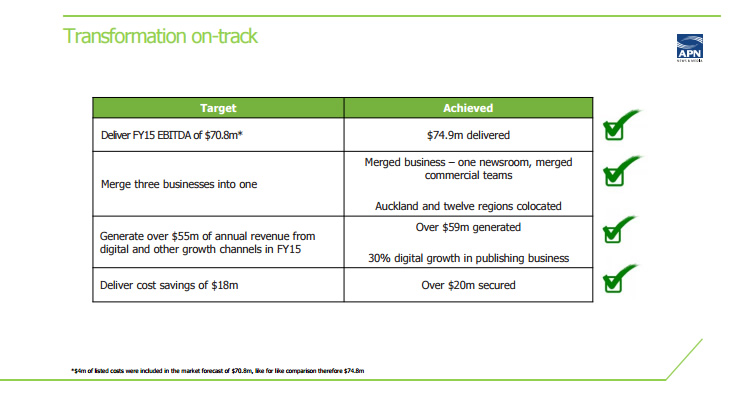

At NZME, the focus of the release was about highlighting that the business transformation was on track, and that cost savings have been realised as they merged three businesses into one. NZME delivered a combined Print, Online and Radio EBITDA of $78.0m.

The NZME radio division saw a decline of 5% in revenue to $120m, whilst EBITDA fell by 3% to $24m. The results have been impacted, according to APN, by a change to the agency buying model, a soft New Zealand economy, and the disrupted survey year in 2015.

APN has confirmed that it is looking to offload its underperforming Australian Regional Media arm, which includes a number of regional newspaper print titles around the country.

Overall APN Highlights:

- Group revenue was up 1% to $850.0m (down 1% on a constant currency basis).

- EBITDA up 1% to $166.2m driven by ARN market outperformance

- Net profit after tax impacted by higher tax expense

- Non-cash impairment charge of $50.8m against ARM mastheads

- Cash flow of $78.2m reduces leverage to 2.74 times

- As per dividend policy, no dividend will be paid for 2015