The Numbers on a Fairfax/Macquarie merger

Bob Peters is Director of Global Media Analysis, and provides financial and strategic consultancy services to the media, entertainment, telecommunications and technology industries with a particular emphasis on the Asia Pacific region.

Bob has had a long history of working with media groups including Austereo, Grant Broadcasters, Prime Media, Southern Cross Broadcasting, Macquarie Radio and MCM.

Bob has written this report on the possible merger of the Fairfax Radio Network with the Macquarie Radio Network.

Summary

In recent days rumours have resurfaced about some form of merger again being under consideration between the metropolitan radio division of the listed Fairfax Media Group (FMG) and the smaller listed Macquarie Radio Network.

In the absence of specific details, it is not possible to be precise about the financial implications of such a merger. However, some general observations can be made based on an assessment of a simple pro- forma consolidation of the recent historical financial performance of Fairfax’s radio operations (FXJ Radio) with those of the Macquarie Radio Network (MRN).

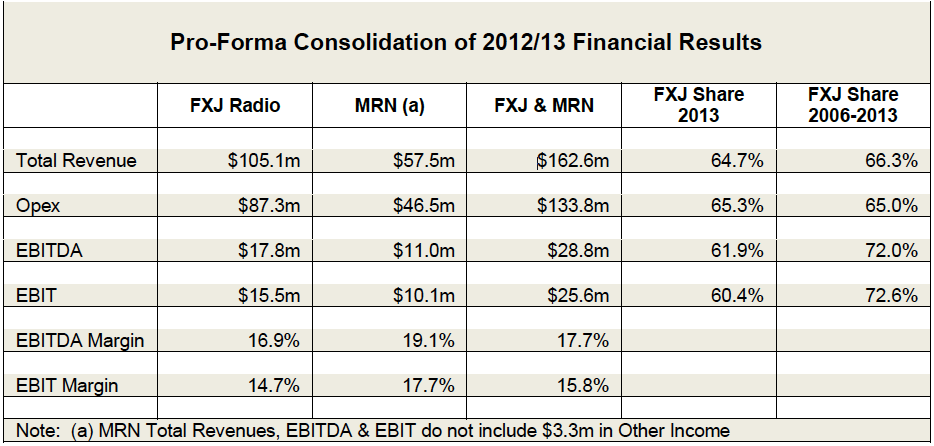

A major conclusion of such a pro-forma consolidation is that FXJ Radio is shown to be broadly twice the size of MRN in terms of both recent revenues and profits and thus it would be reasonable to expect that FMG would be seeking to have majority ownership and management control of any merged radio entity which comprised most of the existing broadcasting assets of the two groups. It is not known how acceptable such a proposition would be to MRN’s current owners

Pro-Forma Consolidation of Historical Financial Performance

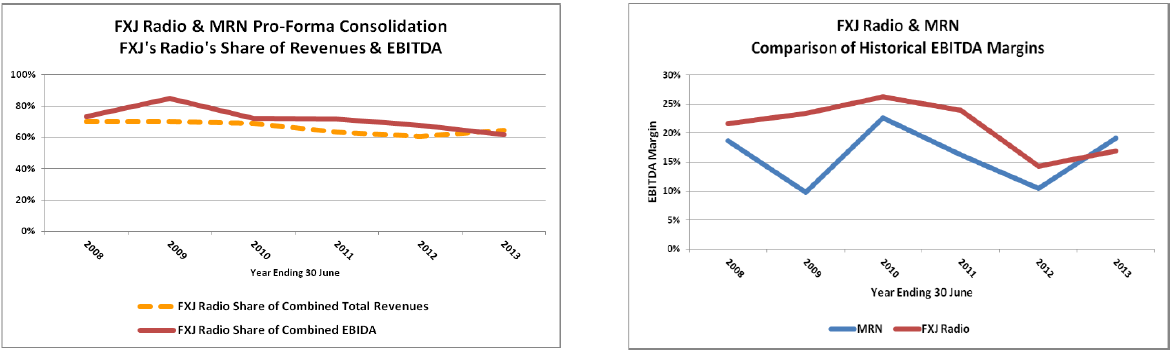

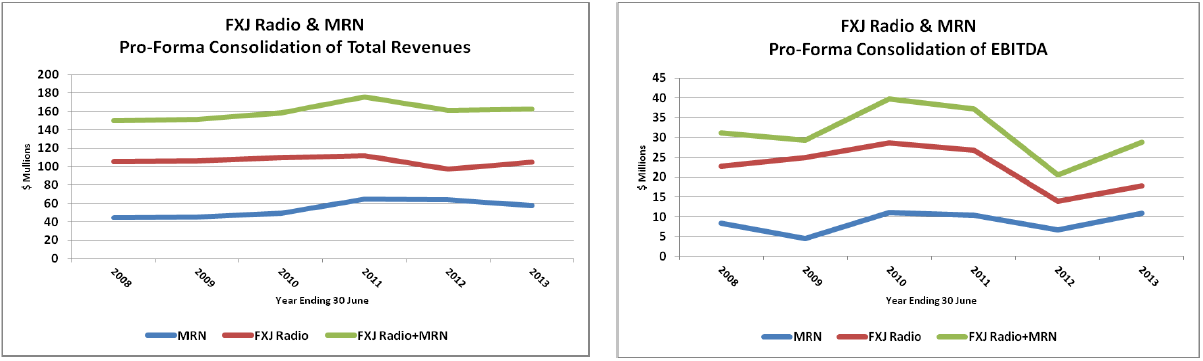

A simple pro-forma consolidation of the historical financial performance of FXJ Radio and MRN, which does not take account of any asset disposals, cost savings or other synergies which would be likely to arise from some form of merger, shows that over the last six years period, the FXJ Radio operations on average accounted for:

- 66.3% of combined total revenues;

- 65.0% of combined operating expenses (Opex) and

- about 72% of profits as measured by both earnings before interest, tax, depreciation and amortisation (EBITDA) and earnings before interests and tax (EBIT).

A pro-forma consolidation also shows that up until the latest 2013 financial year, FXJ Radio enjoyed higher profit margins in terms of both EBITDA and EBIT.

A simple pro-forma consolidation also reveals that had they been combined during the year ending June 2013, the two radio groups together would have generated total revenues $162.6 million, Opex of $133.8 million, EBITDA of $28.8 million and EBIT of $25.6 million.

Global Media Analysis calculates that such a consolidation would produce in Australia’s third largest commercial metropolitan radio group in terms of revenues and the fourth largest in terms of profits.

Further Information

For further information pertaining to this research report, contact Bob Peters of Global Media Analysis at: [email protected]