SCA updates market on improved financial position

Southern Cross Austereo’s (SCA) financial performance for the first part of 2021 was better than expected, with the company issuing a new set of figures today.

The company had predicted that for the period of January 1 to March 31, its year-on-year revenues would be down between 6% and 8%. Today, however, it revealed the blow was less significant than anticipated, and revenues for the quarter are down just 4.3% year-on-year.

By the end of the financial year (June 30, 2021), it forecast its earnings before interest, tax, depreciation and amortisation (EBITDA) would be between $118 million and $125 million. Its EBITDA last financial year was $108.2 million, down significantly from the $147.4 million of the 2019 financial year.

Net debt has also improved. At the conclusion of last financial year, it was $131.6 million, down from FY2019’s $292.6 million. It has forecast now that by the end of June, it will be down to between $55 million and $65 million.

SCA has cut $30 million from its non-revenue related costs since the 2019 financial year, which equates to 10%. It said cost control remains a key focus.

Despite not yet reaching an affiliation agreement with Network 10 after losing the Nine contract, SCA said the negotiations are proceeding well. It predicted the lower cost of programming from 10 would offset the lower revenues it will pull in from Australia’s third-largest commercial TV network.

Audio now accounts for 68% of SCA’s revenue and 81% of its EBITDA, with the remainder coming from TV.

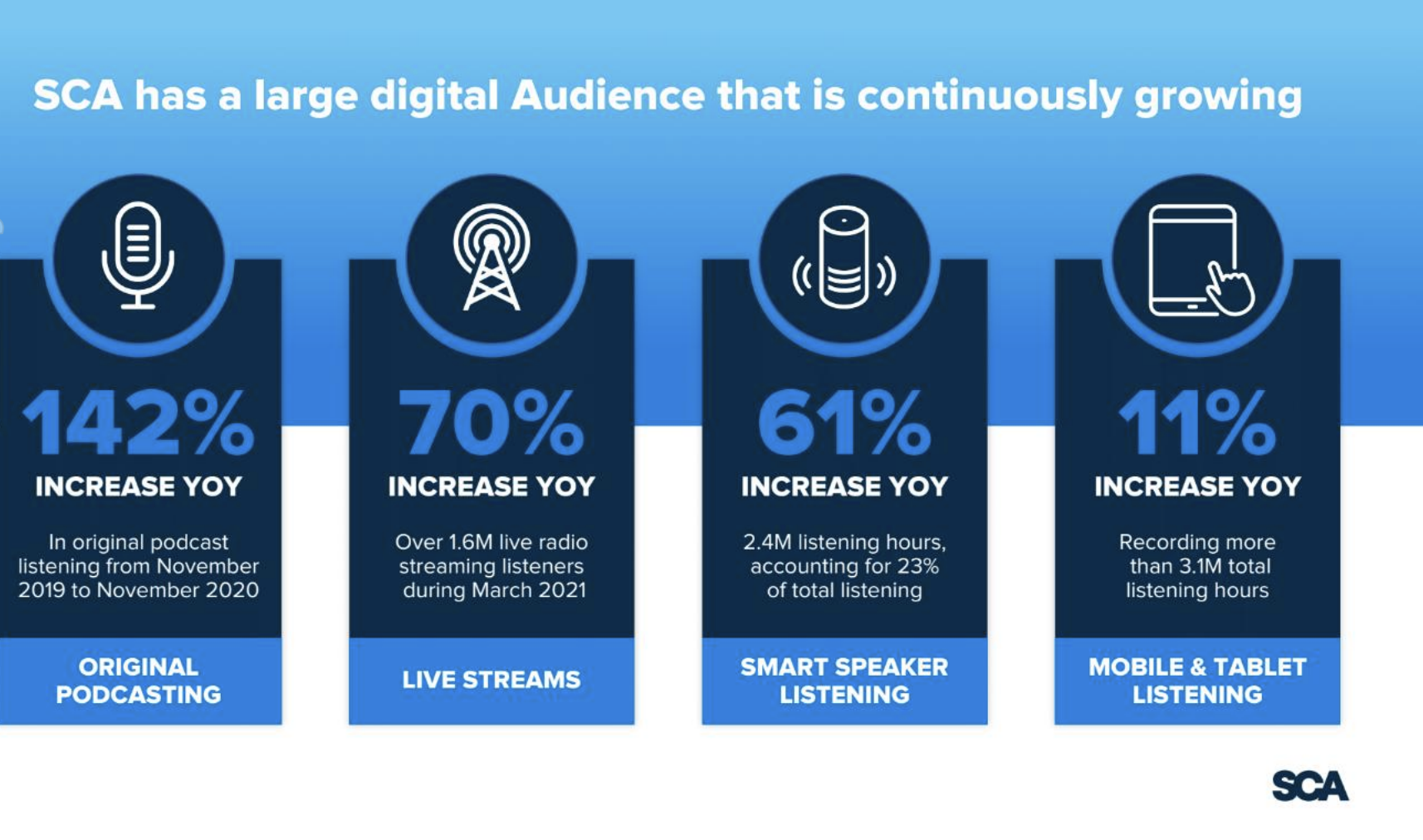

SCA’s increased focus on digital audio was on display in today’s update

The company also used the market update to reiterate its commitment to LiSTNR and making it the “ultimate audio destination” in the country, as well as pursuing a digital audio first operating model.

“The digital audio revenue pool is expanding, and SCA is well positioned to take a leading role in the deployment of new audio products and services – evidenced through our investment in LiSTNR and its considerable audio library,” it said.

SCA has a good result, Radio Today comments go silent.

Typical….

Payback the $32 million in jobkeeper and $10 million in PING and the results are not so flash. Post July when SCA have TEN as TV affiliate you will see a large revenue drop.

Quarterly revenue down 4.3% YOY and that’s a “good result”?

It’s a fine line the SCA folks need to walk at the moment.

Send the “everything is going well” message to the market while not going overboard with it so the next round of redundancies in June/July aren’t as harsh.

I really feel for SCA staffers in the coming months.

Not really Max, comments are always quiet on a Friday.

While the percentage increases look impressive anything upward from the administrators waiting room is good.