Metro Radio Continues to Out-Perform Traditional Media Rivals

Bob Peters is Director of Global Media Analysis, and provides financial and strategic consultancy services to the media, entertainment, telecommunications and technology industries with a particular emphasis on the Asia Pacific region.

Bob has had a long history of working with media groups including Austereo, Prime Media, Southern Cross Broadcasting, Macquarie Radio and MCM.

Bob has written this report on Metropolitan Commercial Radio’s Financial Performance in Fiscal Year 2013.

Summary

The substantial number of on-air line-up changes in metropolitan radio, particularly amongst the top-rating breakfast teams in the Sydney market, which will commence in early 2014 may well have significant financial implications for the major commercial radio groups. It is therefore useful to review the financial performance of those commercial radio groups in year ending June 2013, prior to those major programming changes coming into effect.

Metropolitan commercial radio has been, and continues to be, a solid financial performer during periods of subdued economic activity, as evidenced by the sector’s superior performance to that of its larger traditional media rivals in the most recent fiscal year ending June 2013.

This is one of the main conclusions of the latest annual survey of metro commercial radio performance undertaken by Global Media Analysis (GMA). The GMA survey is based on an assessment of the reported results of five of Australia’s six major commercial radio groups (dmg radio is not included in the survey because it does not publicly reveal its financial performance).

Although its revenue and profit growth was modest, comparatively speaking metro commercial radio’s financial performance last year was still significantly better than that of its main media rivals. For example, metro radio’s slender 0.4% increase in advertising revenues in 2012/13 was nevertheless better than the 2.2% decline in metro television ad revenues and much better than the high teen percentage declines in ad revenues experienced by metropolitan newspapers over the same period.

GMA’s assessment shows that during the year ending June 2013, the five surveyed metro radio groups in aggregate managed to modestly increase total revenues and profits and also to improve profit margins despite a difficult economic environment and a sluggish advertising market.

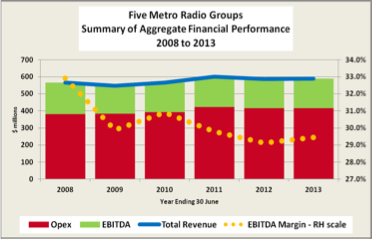

Importantly, GMA’s assessment also shows that over the past five years commercial metro radio has been much more successful than its larger media rivals at limiting the volatility in revenue and profit growth which adversely impacted on the overall media industry as a result of the Global Financial Crisis (GFC).

| Highlights of GMA’s financial assessment were that:

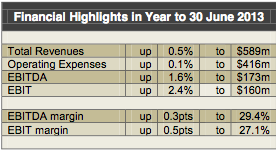

Total Revenues increased by 0.5%; Operating Expenses grew by a lesser 0.1%; EBITDA and EBIT rose by 1.6% and 2.4%; Profit margins improved. |

|

Revenue Performance

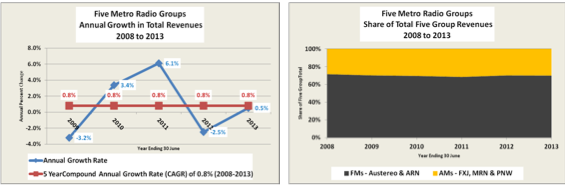

In the year ending 30 June 2013, Total Revenues of the five metro radio groups in aggregate increased by 0.5%, to reach $589 million.

That modest growth in Total Revenues represented an improvement on the previous year’s 2.5% decline, but remained slightly below the five metro groups’ aggregate medium term (2008 to 2013) compound annual growth rate (CAGR) of 0.8%. Like most other media sectors, metro commercial radio has yet to return to its pre-GFC rates of ad revenue growth.

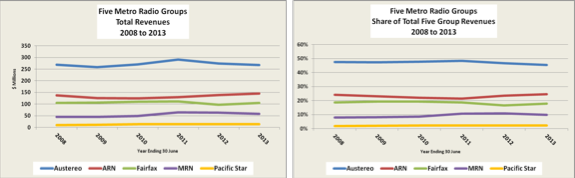

The two largest (and mostly FM station) metro radio groups, Austereo and ARN, continued to together account for about 70% of aggregate Total Revenues, while the remainder of Total Revenues were generated by the three smaller (and mostly AM station) metro groups: Fairfax Radio (FXJ), Macquarie Radio Network (MRN) and Pacific Star (PNW).

Despite experiencing a 2.1% decline in Total Revenues following a difficult year in 2012/13, Austereo easily managed to maintain its longstanding position as the largest metro commercial radio group based on its 45.4% share of aggregate five group Total Revenues.

In contrast, ARN, the second largest metro radio group, for the third straight year continued to increase its share of aggregate five group Total Revenues, with a 5.0% increase taking its aggregate share to 24.6%.

However, it was Fairfax Radio which generated the strongest grow in Total Revenues in 2012/13, with an impressive 8.1% rise, which boosted its five metro group share to 17.8%.

Improved Profitability

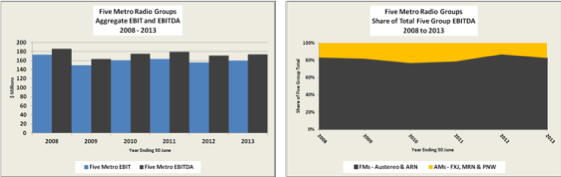

By maintaining a tight rein on operating expenses during fiscal 2013, the five metro radio groups in aggregate managed to increase profits and improve margins despite a low revenue growth environment.

Collective EBITDA and EBIT among the five metro radio groups increased by 1.6% and 2.4% respectively, although each aggregate earnings category still remained slightly below 2008 pre-GFC levels.

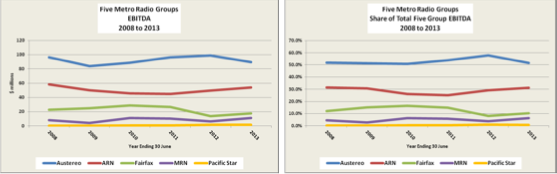

Austereo and ARN together continued to account for the bulk of aggregate five metro group earnings, however their collective share was reduced from about 87% in fiscal 2012 down to 83% last year, as a result of above average profit growth in 2012/13 by both Fairfax Radio and MRN.

Last year, MRN, Fairfax Radio and ARN generated earnings increases, while both Pacific Star and Austereo experienced declines in profitability. Consequently, the former three groups increased their share of aggregate five metro group earnings, while the latter two saw their shares decline.

On an individual group basis, Austereo and ARN continued to command the bulk of the profitability generated by the five metro radio groups in 2012/13.

Overall, there was a modest improvement in aggregate profit margins on both an EBITDA and EBIT basis in 2012/13.

Lower Revenue and Earnings Volatility

When compared to the two larger traditional media sectors of metropolitan television and newspapers, metropolitan radio is shown to be significantly less volatile in terms of revenue and earnings growth during periods of either low or negative growth such as occurred in Australia in the wake of the Global Financial Crisis.

Further Information

For further information pertaining to this research report, contact Bob Peters of Global Media Analysis at: [email protected]