ARN’s parent company HT&E sees profit soar 353%

The parent company of ARN has revealed its financial results to the market today.

Unlike rival Southern Cross Austereo (SCA) which operates on the financial year, Here, There & Everywhere (HT&E) reports on the calendar year.

HT&E’s results today are thus the half-way point and track financial performance from January 1, 2021 to June 30, 2021.

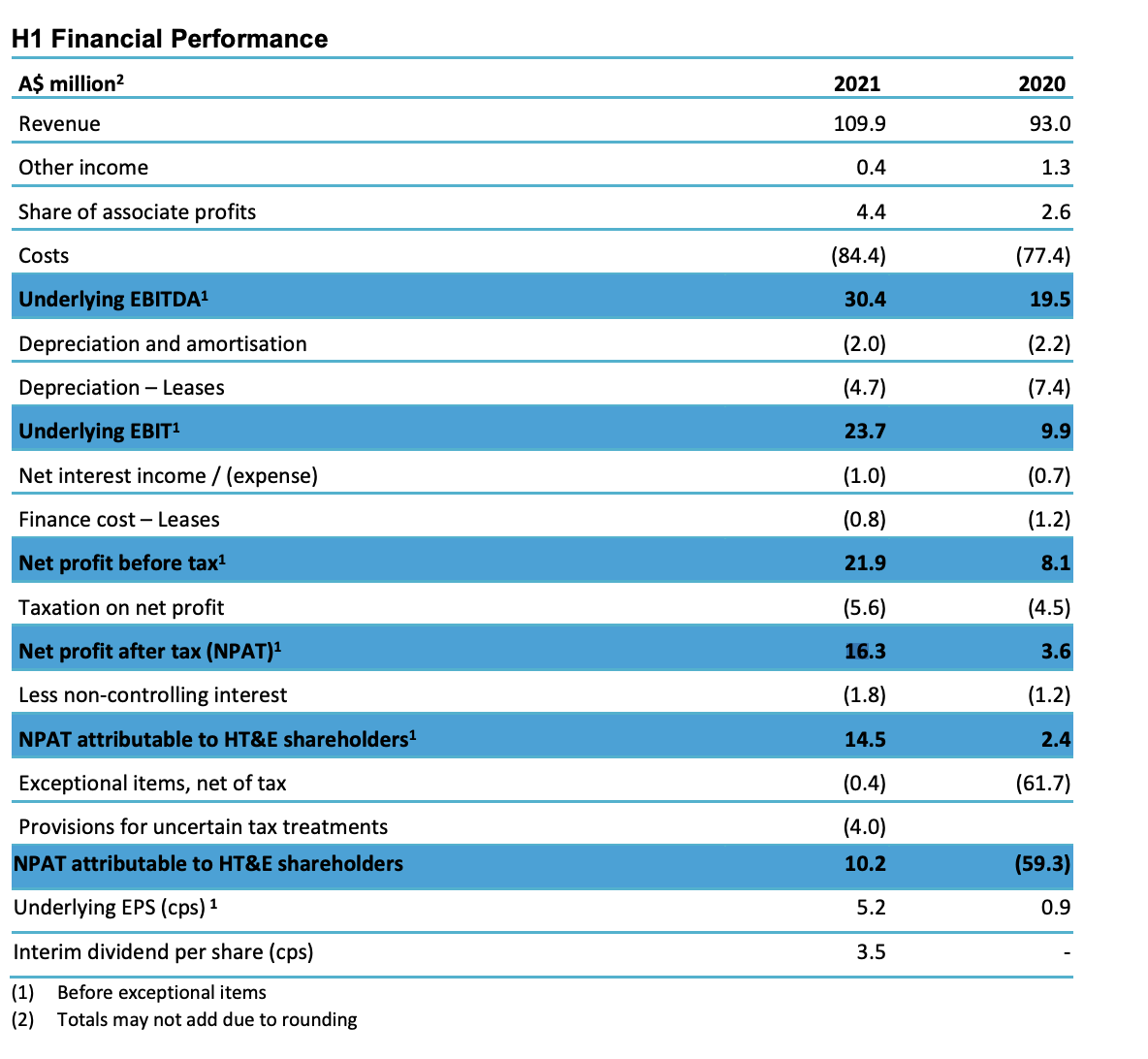

In that time, HT&E generated revenue of $109.9 million, up from $93 million for the same six-month period last year – an 18.2% lift.

Its underlying earnings before interest, tax, depreciation and amortisation (EBITDA) – which is often used to measure the financial performance of ASX-listed companies – was $30.4 million, a 55.9% increase.

HT&E’s net profit after tax (NPAT) was $16.3 million for the half year, up 353% from 2020’s $3.6 million.

HT&E and ARN’s CEO, Ciaran Davis was pleased with the result, but acknowledged the comparisons were coming off a low base last year.

“So last year was dire, so you would expect good, strong growth coming through. I think what we have to do as an industry is look at 2019 as the benchmark level to get back to, and we’re getting close to that,” he told Radio Today.

“I think 2019 is the benchmark we want to get back to. And will we get back to it this year? Certainly up to eight weeks ago, I thought we would, and now I go ‘I think we could’, but it does depend on the extent of the lockdowns, particularly we we come into that retail Christmas period.”

In 2019, HT&E’s revenue for the first half was $130.9 million, which puts this year’s result 16% down on pre-COVID levels. EBITDA was $38.1 million, compared to this year’s $30.4 million (a decline of 20.2% between 2019 and now), and NPAT was $20.1 million (a decline of 18.9% between 2019 and now).

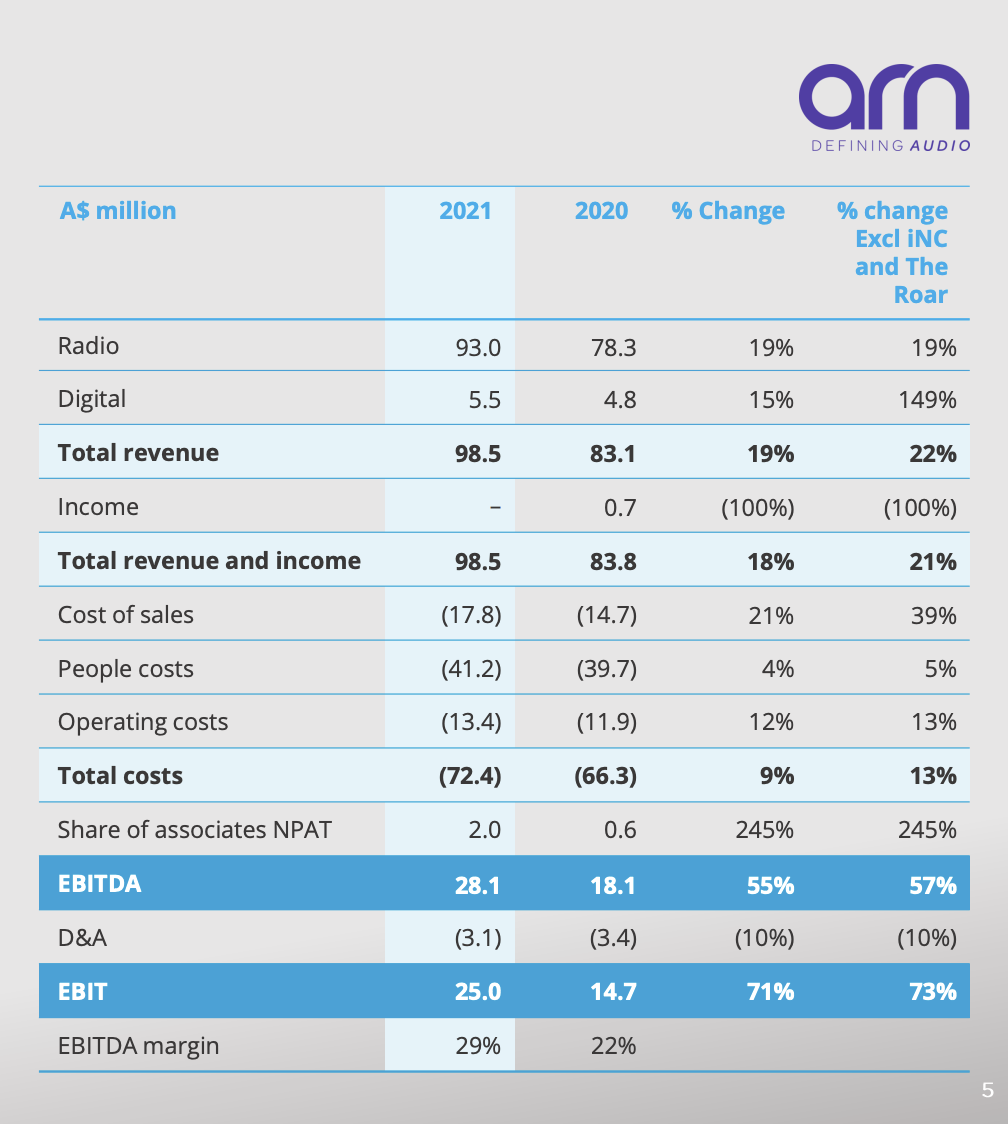

Revenue for radio alone was $93 million this half year, up 19% from last year’s $78.3 million. Digital revenue was $5.5 million, up 15% from $4.8 million. Excluding revenues from the now-defunct The Roar in 2020, digital revenues were up 149%.

ARN’s individual performance

For the six-month period, HT&E spent $17.8 million on selling and marketing, up from $14.5 million last year, but down on the $21.6 million it spent between January and June 2019.

In a statement to investors on today’s results, Davis focused more on its ratings performance and digital innovations.

“What ARN’s network has achieved in terms of ratings performance is nothing short of exceptional and confirms our strategy of investing in the right talent, both on and off air, to drive performance. We are indisputably the dominant player in Australian radio, holding the #1 network position for 13 consecutive surveys,” he said.

“We are also a leader in digital audio, making strategic investments in original content across our platforms to generate market-leading opportunities for our commercial partners. Our digital revenues are up 149%, well ahead of expectations, as we build a richer, smarter and more powerful audio business.

“As Australia’s #1 podcast publisher, we are delivering consistent growth for the iHeartPodcast Network Australia across our diverse content offering. The impressive numbers tell the story, with year-on-year national total downloads on the iHeartPodcast Network Australia for June up 58%.

“We will continue to invest to deliver scale, multi-platform content, digital and data capabilities and in technology that makes it easier to plan and book with our assets.”

ARN need to acquire stations outside their current listening areas ie Hobart, Darwin and another in Perth. Then it is a true national network. Maybe look to expand The Edge via acquiring outer metro stations fringing on metro.