APN’s Radio Buy-Out a Likely Winner

Bob Peters is Director of Global Media Analysis, and provides financial and strategic consultancy services to the media, entertainment, telecommunications and technology industries with a particular emphasis on the Asia Pacific region.

He has had a long history of working with media groups including Austereo, Prime Media, Southern Cross Broadcasting, Macquarie Radio and MCM.

Bob has written this report on APN’s acquisition of the 50% of the Australian Radio Network (ARN), and The Radio Network (TRN) that was owned by the US giant Clear Channel.

There is much that can be said about APN News and Media’s recent acquisition of full ownership and control of its radio operations and all of it is positive.

The attractively priced $A 247 million purchase of Clear Channel Communications’ half interest in the Australian Radio Network (ARN) and The Radio Network (TRN) in New Zealand will give APN full control of a long-established operation with good growth prospects which is both highly profitable and well managed and which has the potential for further financial improvement. Gaining access to the cash flows of ARN and TRN should also provide APN with a valuable strategic buffer against any further financial deterioration in its substantial Trans-Tasman print operations, whose future growth prospects are less certain.

This report highlights some of the key financial aspects of APN’s radio operations in both Australia and New Zealand over the past decade. It demonstrates why Global Media Analysis (GMA) considers this recent transaction to be highly significant as it will not only stabilise APN’s recent financial performance but also position the multi-media group for renewed future growth. GMA’s positive assessment of the recent radio transaction appears to be in line with the views of the majority of APN’s institutional investors who have given their strong support to the equity raising which will partially finance the radio division buyout.

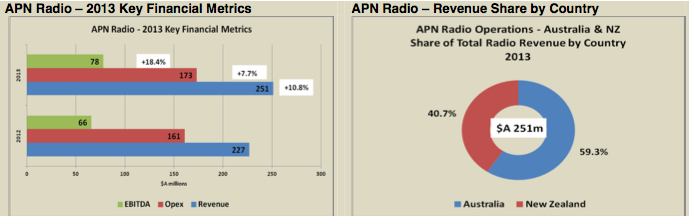

Impressive Growth in 2013

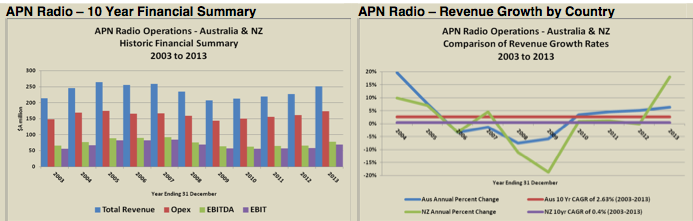

The financial performance of APN’s radio operations in calendar year 2013 (CY 2013), on a fully consolidated basis and expressed in $A terms, was impressive. In the year, total revenues increased by an above average 10.8% to $A 251 million; while operating expenses (Opex) were held to a 7.7% rise to $A 173million. Strong revenue growth and good cost control resulted in earnings before interest, tax, depreciation and amortisation (EBITDA) growing by a significant 18.4% to reach $A 78 million, the radio division’s best profit result since 2007,when it recorded an all time high EBITDA of $A 92 million.

While APN Radio’s aggregate CY 2013 EBITDA margin of 31.1% was itself commendable, it underplayed the industry-leading 39.0% EBITDA margin generated by the Australian radio operations in the year just ended, when Australia accounted for more than 59% of APN Radio’s revenues and 74% of its EBITDA.

APN Radio’s financial performance has been improving steadily in the post Global Financial Crisis period, with revenues, Opex and EBITDA all increasing in aggregate over the past four years since CY 2009 by 20.8%, 20.4% and 21.9% respectively. However, until the past year, that financial recovery has been much more evident in APN Radio’s Australian operations. For example, it was only in CY 2013, that APN’s New Zealand radio operations enjoyed revenue growth which exceeded that of its Australian counterpart for the first time since 2007.

Superior Financial Performance in Australia

While the Australian operations have been the powerhouse of revenue and profit growth for APN Radio in the post-GFC period to date, recent solid growth in the New Zealand economy, combined with favourable exchange rate movements of the $NZ relative to the $A, suggest that the New Zealand radio operations have the potential to make a greater financial contribution in the near future.

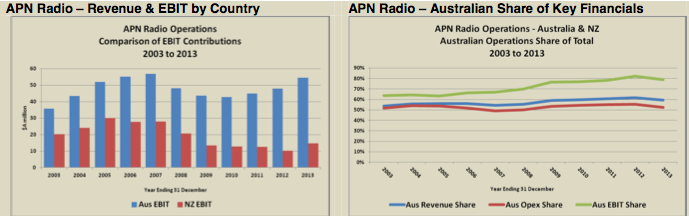

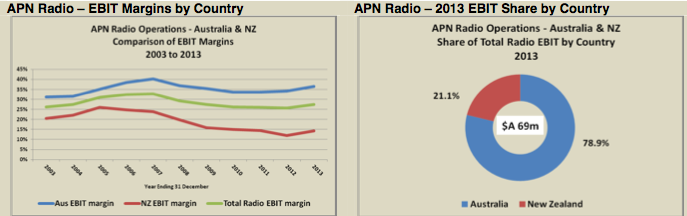

Over the past decade, between 2003 and 2013, the Australian operations of APN Radio increased their share of total radio revenues from 53.8% to 59.3% but, more importantly, they increased their share of total radio EBIT from 63.8% in 2003 to 78.9% in 2013.

Historically, APN’s Australian radio operations have enjoyed significantly higher profit margins than their New Zealand counterparts. In CY 2013 for example, EBITDA and EBIT margins in Australia at 39.0% and 36.6% respectively were roughly double those in NZ of 19.6% and 14.3% respectively. This largely reflects the differing structures of the radio operations in the two countries.

In Australia, the ARN operations consist of six wholly owned and two half owned stations with music based formats which operate in the four largest metropolitan markets plus two half owned stations in Canberra. In contrast, in New Zealand TRN operates a much larger number of stations which are spread throughout the country in both large and small markets and which employ a variety of music, talk and sports formats.

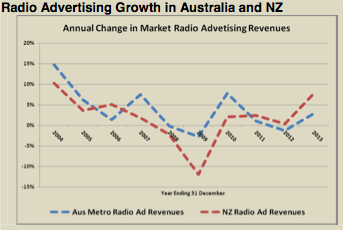

Another contributing factor to the NZ radio Radio Advertising Growth in Australia and NZ operations’ diminishing share over the past decade was the fact that radio market advertising revenue growth across the Tasman was lower than that in the Australian metro markets in six of the past ten years, although that situation has reversed over the three most recent calendar years.

Thus, continuing solid economic growth in New Zealand combined with a $NZ-$A exchange rate hovering not too far above parity should lead to the New Zealand radio operations increasing their contribution to aggregate radio results in the near and foreseeable future.

APN Radio’s future financial growth may also be boosted by the recent signing and commencement of a new high profile breakfast team at FM station 2MIX in Sydney, which has since been re-branded as KIIS 1065, a development which has the potential to significantly increase ARN’s share of radio advertising revenues in the all-important Sydney market.

Further Information

For further information pertaining to this research report, contact Bob Peters of Global Media Analysis at: [email protected]

Disclaimer

The information and opinions in this report were prepared by Global Media Analysis (GMA) on information which GMA believes to be reliable. However GMA makes no representations as to the accuracy or completeness of such information. No reliance should be placed on information contained in this report without prior consultation from GMA as to your specific requirements. GMA may have current or prior advisory relationships with some of the companies or individuals referred to in this report.

Any information provided is subject to change without notice to you although the information includes material as well as research commentary relating to media matters. GMA is not providing advice though this report and does not represent that any such advice or commentary is suitable to you.

You the reader agree to make your own independent evaluation of the merits and suitability for you of the commentary given which reflects the author’s analysis as of the date published. The accuracy, completeness and timeliness of such information cannot be guaranteed and is subject to change.

GMA, its affiliates, agents and directors shall not have any responsibility for direct, indirect, consequential, special or other damages you incur as a consequence of your reliance on information provided in this report and GMA, its affiliates, agents and directors hereby expressly disclaim all express and implied warranties, including without limitation, warranties of merchantability, fitness for a particular purpose and error-free and uninterrupted services. GMA does not warrant, guarantee or make any representation or warranty whatsoever express or implied or assume any liability to you regarding:

1. the use of the results of the use of the information provided including without limitation any financial results based on use of the information, or;

2. system performance and effects on or damages to software and hardware in connection with any use of any GMA site containing this report.

In addition to and without limiting the foregoing, GMA shall not be liable for any harm caused by the transmission, through any GMA Site, of a computer virus or other computer code or programming device that might be used to access, modify, delete, corrupt, deactivate, disable, disrupt or otherwise impede in any manner the operation of the services of any of your software, hardware, data or property.