Defining Radio’s Future In One Word: Mobile

Six years ago this month, we were running around Dallas, Los Angeles, Baltimore, and Cleveland observing consumers using their mobile devices – or smartphones. Our “Goin’ Mobile” ethnographic study – in partnership with Arbitron – was radio’s first real look at the impact of mobile phones in people’s lives. And it was a breakthrough research study at that time.

We observed some amazing things back in 2010.

We followed a young lady in a grocery store using an app that helped her locate gluten-free products to match her dietary needs.

We watched a small business owner sneakily taking smartphone photos of products and prices at his big box competitors.

We looked on as three middle-aged women went out to lunch in a Mexican restaurant, staring at their smartphones, barely speaking to each other.

And we rode around with drivers so addicted to their smartphones, they continually sent and read text messages even in winter weather.

Now today, you read these descriptions of smartphone behavior, and you wonder what’s the big deal? But back then, the rise of these handheld computers in our lives was just emerging, far from the mainstream and even dominant activity it’s become today.

Now we know better. We all carry these devices and we know the impact they’ve had on our personal lives and on our careers. But as radio professionals, have we really accepted the truth about mobile phones and what they mean to the future of the industry?

Two weeks ago we posed four ginormous questions we feel radio must answer in order to grow and remain competitive:

What is radio?

What are ratings?

What is content?

What is in-car entertainment?

We’ve received many comments about this post as theories and opinions turned out to be as different and diverse as those of you who read this blog. And so to perhaps make matters simpler, the Pew Research Center has just released a study that begins to answer that first question: What is radio? And in the process, Pew may be down the path of helping us address the other three as well.

For the past several years, our Techsurveys have illustrated the rampant growth of smartphones and tablets as the devices of choice that connect consumers to their favorite content via apps and the web. We’re talking music, social media, information, entertainment, and yes, radio.

Perhaps it is less about a rush to mobile, and more about that “who cares where it comes from?” mindset that has totally redefined the television industry. For traditional radio stations, we continue to see – in both commercial and public radio environments – consumers choosing their preferred content on myriad devices, from traditional AM/FM radios to laptops to mobile phones and tablets. They move from one to the other, depending on where they are, what they’re doing, and what’s available.

The trend is unmistakable, as consumers in markets as broad and diverse as Dallas to Decatur are comfortable expanding their definition of “radio” as audio content coming to them as live over-the-air broadcasts, streams they can take with them wherever they go, bite-size on-demand podcasts, social posts, and web video. And now they can access this content on any number of devices whether it’s a traditional radio, a laptop, a mobile device, a smart TV, or something they’re wearing on their wrists. That is, if we make it available to them in user-friendly, simple interfaces that allow the freedom and choice.

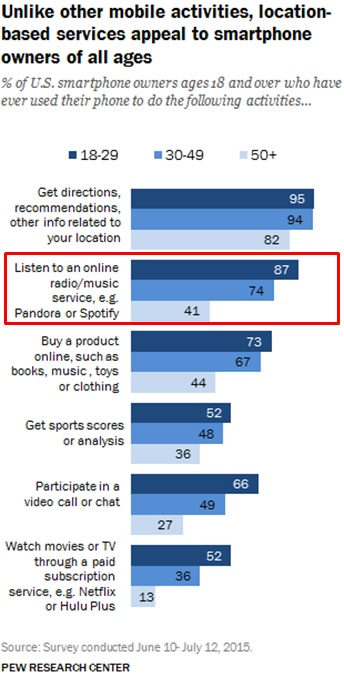

But it is mobile that has transformed the landscape, and now Pew has sealed the deal with a new study that suggests not only have smartphones changed the way we access audio, video, movies, maps, and shopping portals, there is no sign of it slowing down. Not surprisingly, this is happening fastest with young adults – the demographic of the future and one where the radio industry’s grasp is very tenuous. And older generations are rapidly catching up with these Millennials:

According to Pew, nearly nine of ten smartphone owners in the 18-29 year-old group have listened to an online stream or music service on their Apple or Android handsets. (Second only to accessing maps, that makes audio streaming their top mobile phone activity.)

And the data is nearly as impressive among Gen Xers (30-49s), three-fourths of whom have done the same thing, along with four in ten Boomers (50+).

To a growing number of consumers, “radio” isn’t a box that sits on a table or a clock radio. They are device-agnostic and don’t define “radio” as anything more than audio content they prefer and can access wherever and whenever they like. If anything, they often have greater access to their mobile devices (while they drive, eat, work, and even sleep) than they do a “regular radio.”

This presents a significant challenge to those who continue to view radio through “the way it’s always been” lens. Consumer behavior has changed, and there’s no going back, No matter what traditionalists argue about streaming being too expensive or how radio will always be dominant in the car, the toothpaste is indeed out of the tube.

Conveniently, the Pew data doesn’t just help us understand the new way in which consumers define “radio,” it goes a long way towards answering all four of the questions we posed in our previous blog. That’s because once broadcasters fully embrace the mobile revolution and begin to re-purpose the infrastructure of the industry around that reality, then radio will be in a position to truly monetize streaming and mobile initiatives, making this usage a significant part of the business model.

This means final acceptance and implementation of the Nielsen SDK in order to combine ratings generated from online and mobile streams with terrestrial ratings in order to redefine what ratings actually are so traditional radio salespeople can properly monetize them.

This means re-defining the parameters of content, broadening the approach to aggressively providing radio programming online with an outstanding user experience, and offering podcasting and on-demand content that’s accessible in all mobile platforms.

And it means creating an outstanding UX in the car and investing in radio apps being accessible in Android Auto, Apple CarPlay, and dashboard interfaces such as Ford and Toyota’s Smart Device Link.

And it means creating an outstanding UX in the car and investing in radio apps being accessible in Android Auto, Apple CarPlay, and dashboard interfaces such as Ford and Toyota’s Smart Device Link.

When we first posted those four questions, we knew they were daunting and complex. With this Pew Study, along with surveys like the Infinite Dial, and our Techsurveys, the answers are becoming clearer. A mobile device isn’t just another appliance like a microwave oven, a Shop Vac, or a Swiffer. Smartphones are game-changers, and the cultural evolution is far from over.

Just like we did six years ago with “Goin’ Mobile,” the key to understanding it is to become a great observer – of your own habits. You don’t need to interview a group of smartphone-carrying consumers like we did back in 2010.

It’s as simple as reaching into your pocket, your purse, your briefcase, or your backpack, and looking at your smartphone in a whole new way. It’s about understanding your own usage patterns – the apps you download, how you use them, and the experience they provide. It starts with asking yourself challenging questions about the accessibility and user experience your brand provides consumers when they pull out their smartphones time and time again, day after day.

Mobile is one test that radio simply cannot afford to fail.

Paul Jacobs

Vice President, General Manager Jacobs Media

Paul provides sales consulting services for Jacobs Media. As an expert in all Rock formats, Paul helps Jacobs clients understand how to sell, market, and position their formats via sales training seminars. He has conducted hundreds of client presentations on behalf of Jacobs Media clients, and has aided the Ford Motor Company and Procter & Gamble in improving their understanding of the youth market. Paul is a true “format champion” – someone who believes in the power of branding, and developing radio’s

You can find out more about Jacobs Media here.