APN AGM: The Results / The Strategy

APN News & Media, CEO Ciaran Davis has well and truly put his stamp on the future of the business with the company AGM this morning.

Outside the earlier news on Radio Today that APN plans to demerge NZME from the APN business, Ciaran outlined the strategic direction APN will now take with its Australian media assets.

In Ciaran’s CEO Address to shareholders he said:

“My vision for APN is to become a growth‐oriented company with leading assets in radio and outdoor.

“The opportunities we have identified to position APN for further growth are underpinned by our evolving strategy.”

The Results Summary:

On APN’s 2015 Financial Results, revenue and EBITDA both increased. Total revenue increased one per cent to $850m while EBITDA increased to $166.2m.

Cash flows of $78.2m were achieved in the year and APN’s leverage is down to 2.74x down from 3.1x. This followed the acquisition of 96FM in January last year.

Below is an excerpt relating to APN’s Radio assets from Ciaran Davis CEO address to shareholders at the AGM.

Australian Radio Network (ARN)

Starting with ARN. In 2015, ARN was Australia’s number one metropolitan radio network. A fantastic feat in a competitive radio industry.

In Sydney, ARN’s KIIS and WSFM were the #1 and #2 FM radio stations with their respective breakfast teams of Kyle and Jackie O and Jonesy & Amanda solidifying the #1 and #2 FM positions.

ARN also continued its leadership positions in Brisbane and Adelaide where 97.3FM and Mix 102.3 finished the year as the #1 FM stations in their respective cities.

In the Drive daypart, ARN launched the Hughesy and Kate national Drive program at the beginning of 2015, acknowledging the importance of the daypart in generating national revenues. Impressively, by the end of the year, the team had achieved the #2 position in Drive.

All of this success culminated in the KIIS brand finishing 2015 as the #1 national radio brand in Australia.

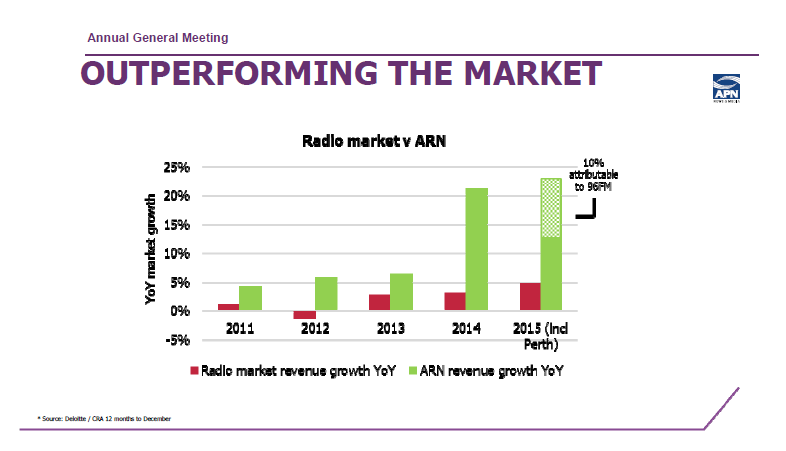

Over the last five years, ARN has consistently outperformed the market highlighting the importance of ratings success to drive revenue.

In 2015, the overall radio market grew 4.8 per cent – a very strong indicator of the robustness of the industry.

ARN increased revenues by 22 per cent with just under half of this growth attributable to the acquisition of Perth’s 96FM which completed in January 2015.

iHeartRadio

iHeartRadio Australia continues to go from strength to strength.

In 2015, registered users increased 52 per cent to 527,000; app downloads increased 53 per cent to 803,000 amounting to 2.4m in monthly streaming hours. These strong figures have contributed to a 49 per cent increase in 2015 iHeartRadio revenue.

We continue to invest in iHeartRadio as a multi‐platform brand extension to ARN’s radio offering generating new revenue for the business.

New custom stations, events and partnerships such as the commercial agreement announced with Optus aligns to iHeartRadio’s strategy of giving audiences the opportunity to get closer to the music they love anytime, anywhere and for free.

NZME

And finally, to NZME ‐2015 was a significant year with the business delivering on all of the transformation targets.

EBITDA forecasts were overachieved delivering just under $75m.

With a target of $18 million in cost savings, NZME secured over $20 million in 2015.

Merging three businesses into one, NZME successfully launched one newsroom and combined commercial teams, bringing together expertise and capabilities from the publishing, radio and digital teams which has delivered audience growth and commercial opportunities.

The business also achieved over $59 million of revenue from digital and other growth channels. Against the backdrop of significant change, the business continues to provide quality and industry leading content.

Having refocused NZME into the audience and content categories of News, Sport and Entertainment, NZME brands have continue to lead in their respective categories The New Zealand Herald is the #1 news media brand in the country with NewstalkZB the #1 news radio station.

Radio Sport continues to be the #1 sports radio station, and Coast has secured the #1 music and entertainment radio ranking in the country. The focus of new revenue initiatives has diversified the NZME offering beyond its traditional publishing and radio assets.

Over the last year, we have seen the launch of numerous new verticals and digital products including:

• NZME Vision;

• WatchMe, a video‐on‐demand service platform;

• CreateMe;

• NZ Herald Focus, a twice daily video news show filmed in the NZME newsroom; and

• Driven, an integrated content and listings website

The priority now is to position NZME for further growth and, for the reasons we outlined in today’s announcement, we believe a demerger of the business is the best way forward for NZME.

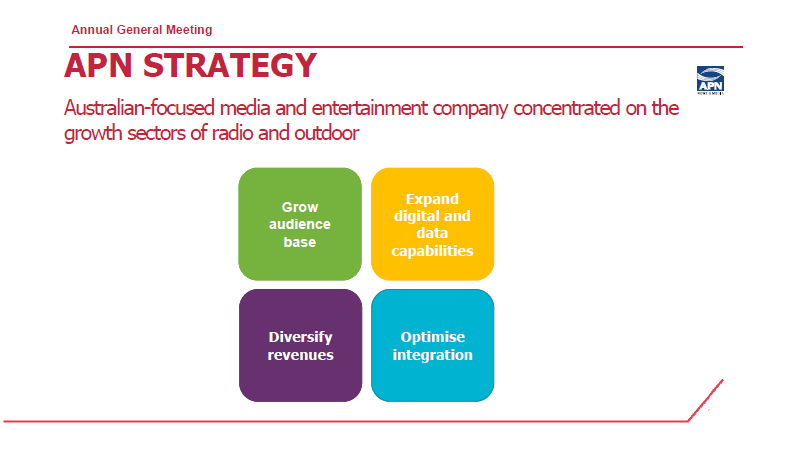

APN strategy

I want to briefly outline APN’s focus and priorities will be should the Demerger go ahead. My vision for APN is to become a growth‐oriented company with leading assets in radio and outdoor. The opportunities we have identified to position APN for further growth are underpinned by our evolving strategy. That is:

• To grow our audience base enhancing our products, services and offering to deliver the best experience for audiences;

• To expand our digital and data capabilities to be able to compete for audience and advertiser revenues in today’s rapidly evolving media landscape;

• To diversify our revenues so we can continue to invest in our products and create a capital structure that provides value for our shareholders; and

• To optimise integration, identifying unique opportunities that drive new revenues and streamline cost structures.